Analyzing Cian Agro Share Price Trends in 2023

Introduction

The share price of Cian Agro Industries Limited has garnered significant attention in recent months due to its performance and the agricultural sector’s fluctuations in India. Understanding the dynamics of Cian Agro’s share price is crucial for investors, stakeholders, and analysts, as it reflects both the company’s market position and the broader economic factors impacting the agribusiness sector.

Latest Developments

As of October 2023, Cian Agro’s share price has shown resilience amidst various market challenges. The stock opened at INR 105 and fluctuated between INR 95 and INR 110 over the past weeks. Analysts have attributed this stability to the company’s robust quarterly financial results, which indicated a growth in sales and profitability, despite the slowdown in some agrarian segments.

Furthermore, Cian Agro is benefitting from increasing demand for its products, largely due to government initiatives promoting sustainable agricultural practices. The company’s expansion plans and new product lines introduced in recent months have also contributed positively to investor sentiments.

Market Performance and Analysis

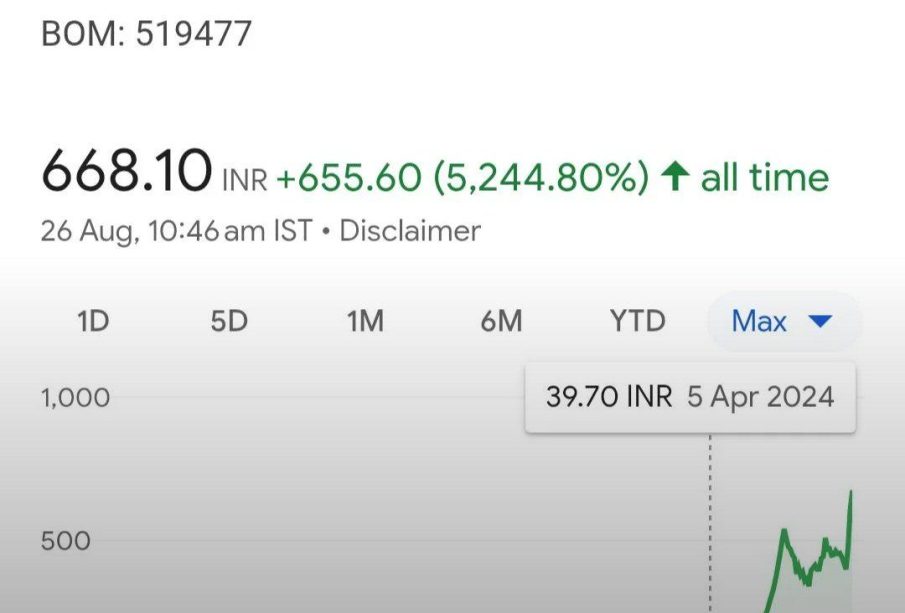

In comparison to its sector peers, Cian Agro’s performance has been commendable. The stock has gained approximately 15% over the past three months, outpacing many competitors in the agri-sector. Factors such as favorable weather conditions, timely government subsidies, and an uptick in rural consumption are projected to benefit the company further.

Analysts recommend a cautious but optimistic outlook for Cian Agro’s shares over the next few quarters. While macroeconomic factors such as inflation and global commodity prices remain a concern, the company has established a solid foundation to withstand market volatility. Institutional investors have also shown increased interest, adding to the stock’s appeal in the eyes of retail investors.

Conclusion

In summary, Cian Agro’s share price is a reflection of not only the company’s internal strategies and market performance but also the broader economic environment affecting the agricultural sector in India. With a positive growth trajectory and ongoing investment in innovation, the future appears promising for Cian Agro Industries. Investors are encouraged to conduct thorough research and consider market conditions when making investment decisions regarding Cian Agro shares. As the company continues to evolve, it remains a stock to watch in the coming months.