Analysis of Solar Industries Share Price Movement

Introduction

The share price of Solar Industries India Ltd., a leading manufacturer of industrial explosives and defense supplies, has garnered significant attention in the stock market recently. Understanding the fluctuations and trends in its share price is crucial for investors and stakeholders alike, as it reflects not just the company’s financial health but also the broader market sentiment towards the defense and manufacturing sectors.

Recent Trends

As of late October 2023, Solar Industries’ share price has shown an upward trend, closing at ₹2,688, a substantial rise of approximately 3.5% over the past month. Analysts attribute this rise to several factors, including robust quarterly earnings, increased demand for explosives in infrastructure projects, and renewed interest in defense manufacturing. The company reported a 20% increase in revenue for the third quarter, showcasing its capacity to adapt to market demands, which has bolstered investor confidence.

Increased Demand

The Indian government’s push for infrastructure development has led to a surge in demand for industrial explosives. Projects under the National Infrastructure Pipeline are anticipated to boost the revenues of companies like Solar Industries. Furthermore, the company has secured significant contracts that are expected to contribute positively to its bottom line.

Market Analysis

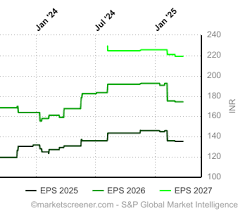

Market analysts have maintained a positive outlook on Solar Industries. Their robust business model and strategic positioning in the market make them a formidable player in both domestic and international arenas. With recent government initiatives aimed at enhancing the manufacturing and defense sectors, Solar Industries is poised for continued growth. According to market experts, the stock may reach new highs, contingent upon sustained demand and the company’s operational efficiency.

Conclusion

Investors looking to engage with Solar Industries should keep an eye on market dynamics and the company’s quarterly performance. The current positive sentiment surrounding Solar Industries share price reflects wider trends in infrastructural development and strategic government focus on defense. As we move towards the end of the fiscal year, the company’s ability to deliver on its forecasts and manage its growth will be vital in determining its future share performance. Therefore, staying informed and analyzing market trends will be essential for investors looking to make informed decisions in this promising sector.