Analysis of MMTC Share Price Trends and Insights

Introduction

The share price of MMTC Ltd. (Metal and Minerals Trading Corporation of India) is not just a reflection of the company’s performance but also indicates the trends and sentiments of the Indian metals and trading market. As a government-owned trading company, MMTC plays a critical role in the import and export of a variety of minerals and metals, making its share price a significant point of interest for investors and market analysts alike. Understanding MMTC’s share price movements helps gauge the overall health of the commodities market in India.

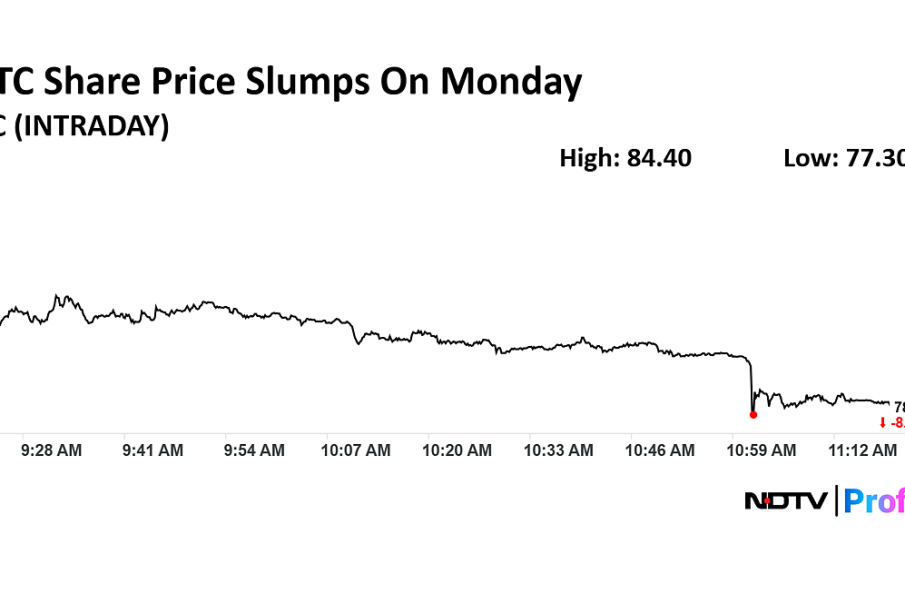

Recent Market Performance

As of late October 2023, MMTC’s share price has been experiencing fluctuations due to various global and domestic market factors. On October 20, 2023, MMTC shares were trading at approximately ₹55 per share, showcasing a slight increase of 2% from the previous week. This uptick can be attributed to rising demand for gold and silver in the domestic market ahead of the festive season, which typically sees increased consumer purchases.

In the past month, MMTC has also benefitted from favorable international commodity prices and an increase in mineral exports. The recent reports indicate that MMTC’s net profit rose by 15% year-on-year in the last quarter, prompting positive investor sentiment. Additionally, the government’s push for increased imports of fertilizers and energy minerals has added to the trading volumes of MMTC, affecting the share price positively.

Factors Influencing MMTC Share Price

Several factors influence the fluctuations in MMTC’s share price: trends in global commodity prices, government policy changes, and domestic consumption patterns. The volatility in gold prices, for instance, has a direct impact since MMTC is also involved in gold importation. Moreover, any regulatory changes pertaining to foreign trade can significantly affect MMTC’s operational dynamics and, consequently, its share value.

Conclusion

In summary, tracking MMTC’s share price is crucial for investors looking to capitalize on market trends in the minerals and metals sector in India. With the prospect of a robust performance driven by festive season buying and supportive government policies, MMTC stands at an interesting crossroads. Investors should keep a close eye on external economic indicators and company announcements, which will likely shape the future trajectory of MMTC’s share price. Overall, understanding these dynamics can aid in making informed investment decisions and anticipating potential market shifts.