Adani Group: Navigating Growth Amidst Market Scrutiny

Introduction

The Adani Group, one of India’s largest conglomerates, has become a focal point of discussion in the business world due to its ambitious goals in various sectors, including renewable energy, infrastructure, and logistics. The relevance of the Adani Group’s performance in 2023 holds significance not just for investors, but also for the broader Indian economy, especially as the country aims for sustainable growth. In recent months, the group has faced a blend of challenges and opportunities that are reshaping its future trajectories.

Current Developments and Challenges

In January 2023, Adani Group faced considerable pressure following a report by Hindenburg Research, which alleged stock manipulation and accounting fraud. The allegations prompted a significant decline in the group’s stock prices, erasing billions in market capitalization. However, the group has vehemently denied these claims and has been actively working to address investor concerns. The company’s chairman, Gautam Adani, announced a strategic plan to mitigate risks and enhance transparency.

Despite the turmoil, the Adani Group has maintained its commitment to expanding its renewable energy portfolio. The conglomerate is poised to become one of the largest renewable energy producers in the world, with plans to invest over $20 billion in the solar and wind sectors by 2030. This shift to sustainable practices aligns with India’s commitment to achieve net-zero emissions by 2070, presenting both a challenge and an opportunity for further growth.

Investment and Future Outlook

In July 2023, the Adani Group announced partnerships with global investors to bolster its financial stability. These strategic alliances are aimed at countering the financial strain from share price volatility and enabling the group to continue its ambitious infrastructure projects across the country. Industry experts have indicated that while the short-term outlook may remain volatile, the focus on green energy investments could position the group favorably in the long term.

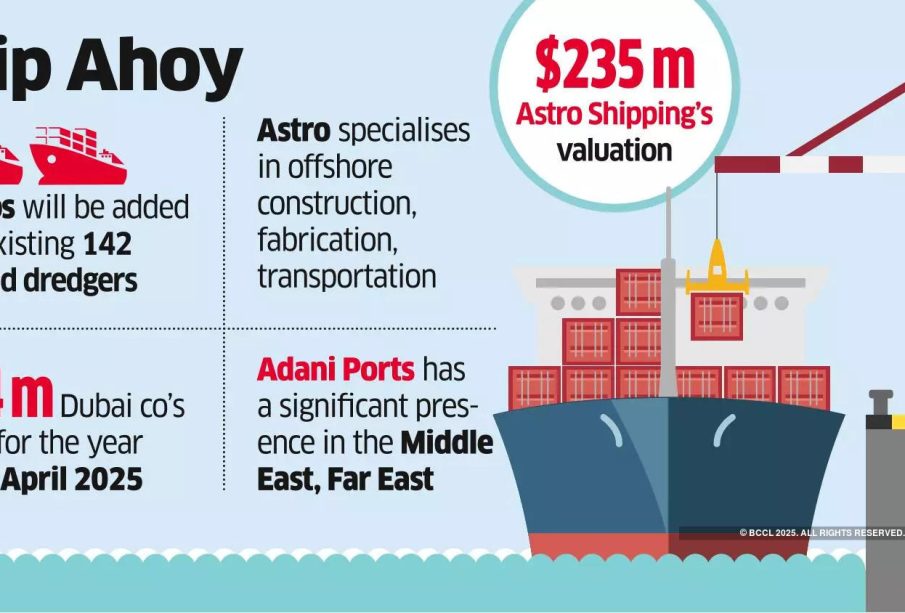

Moreover, the government’s focus on enhancing infrastructure in India plays well into the Adani Group’s plans, as they aim to secure lucrative contracts in sectors such as ports, logistics, and power generation. As the Indian economy continues its recovery post-pandemic, the potential for growth remains significant.

Conclusion

The Adani Group’s journey in 2023 highlights the importance of resilience in the face of challenges. As the company pushes forward with its renewable energy goals and adapts to market pressures, it is likely to remain a key player in India’s economic landscape. For readers and investors, monitoring the Adani Group’s developments offers insights into the dynamics of corporate governance, market volatility, and the intersection of sustainable growth and economic power.