Adani Enterprises Share: Recent Trends and Future Outlook

Introduction

Adani Enterprises, a major player in the Indian business landscape, has been the subject of intense scrutiny and interest lately. As the flagship company of the Adani Group, it plays a pivotal role in shaping the renewable energy and infrastructure sectors in India. Understanding the performance of Adani Enterprises shares is crucial for investors, market analysts, and the general public, given the company’s scale and influence on the markets.

Current Performance

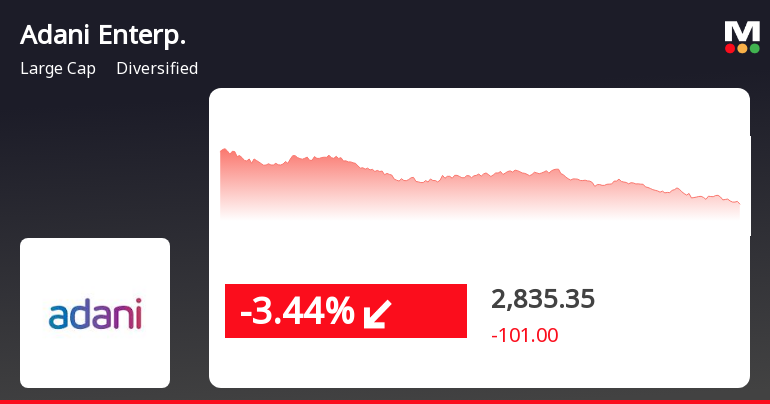

As of October 2023, Adani Enterprises shares have experienced significant volatility. After reaching record highs earlier in the year, the stock faced pressures due to a combination of poor earnings reports and broader market corrections influenced by global economic trends. The stock recently traded at around ₹2,000, representing a considerable drop from its peak of over ₹3,000, amid concerns related to financial practices and regulatory scrutiny.

Recent Developments

Key developments in the company have added to the stock’s volatility. In September, the company announced plans to expand its renewable energy portfolio, which could potentially influence share prices positively in the long run. However, lingering doubts around debt levels and corporate governance have created caution among investors, leading to fluctuating share price movements.

Market Sentiment

The market sentiment towards Adani Enterprises shares has been mixed. While some analysts suggest that the current dip presents a buying opportunity for long-term investors who believe in the company’s growth trajectory, others urge caution, citing the importance of addressing governance concerns. The company’s commitment to sustainability and its diversification strategies are viewed as positive factors that could bolster investor confidence over time.

Conclusion

In conclusion, Adani Enterprises shares continue to be a focal point for Indian investors, balancing potential with risks. For those considering an investment, it’s crucial to stay informed about company developments and market conditions. Financial analysts will be closely monitoring the company’s upcoming financial results, as they are likely to impact share prices significantly. Investors should weigh the company’s innovative strategies against the backdrop of its governance issues to make informed decisions in an ever-evolving market landscape.