Acme Solar Share Price: Trends and Market Impact

Introduction

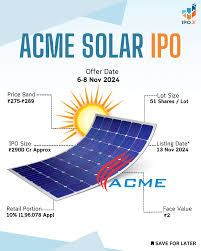

The share price of Acme Solar has captured the attention of investors and analysts alike as the renewable energy sector gains momentum globally. With increasing demand for clean energy solutions and government incentives for solar projects, understanding the fluctuations in Acme Solar’s share price is crucial for potential investors and stakeholders. This article delves into the latest trends affecting Acme Solar’s market performance.

Recent Trends in Acme Solar Share Price

As of October 2023, Acme Solar’s share price has experienced notable fluctuations, reflecting both investor sentiment and broader market conditions. The stock saw an initial surge when the company announced a new partnership with major energy firms to expand its solar farm operations. This collaboration is expected to bolster production capacity and boost revenues, which positively impacted the stock price.

However, Acme Solar’s share price also faced pressure due to prevailing concerns regarding rising material costs and supply chain disruptions. The solar industry has seen increased demand for raw materials like silicon, which can adversely affect profitability if costs are not controlled. In September 2023, Acme Solar reported mixed quarterly earnings, further adding to the volatility of its share prices. Nevertheless, the company’s forward-looking strategies, including diversifying its energy sources and enhancing technology, seem to provide a buffer against these challenges.

Market Significance

The share price movements of Acme Solar not only reflect the company’s individual performance but also act as a barometer for the renewable energy sector in India. Investors are keeping a close watch on policy changes affecting solar energy promotion, including potential subsidies and tariffs. Analysts expect that a stable regulatory environment will support stock prices in the longer term.

Moreover, as more investors show interest in sustainable companies, the share price of Acme Solar could benefit from increased demand in the market, potentially leading to further gains. Experts suggest that navigating the current global energy transition could provide a significant advantage for companies like Acme Solar.

Conclusion

In conclusion, while Acme Solar’s share price has faced volatility due to various external factors, the company’s strategic initiatives and the overall growth of the renewable energy sector present a compelling case for investors. Monitoring market trends, policy changes, and the company’s operational developments will be essential for anyone interested in Acme Solar. Future forecasts remain optimistic, particularly as clean energy continues to gain traction globally, positioning Acme Solar favorably in the evolving energy landscape.