Understanding the KOSPI Index and Its Significance

Introduction

The KOSPI Index, short for Korea Composite Stock Price Index, is a crucial barometer of South Korea’s stock market performance and a key player in global finance. It tracks the performance of all common stocks listed on the Korea Exchange (KRX) and serves as a pivotal reference for investors and policymakers alike. Given the increasing importance of South Korea’s economy in the global market, understanding the KOSPI Index becomes indispensable for anyone interested in Asian financial markets.

Current State of the KOSPI Index

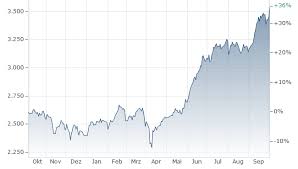

As of late 2023, the KOSPI Index has shown significant volatility, reflecting both domestic economic conditions and global market trends. After a period of decline earlier in the year due to concerns around inflation and geopolitical tensions, recent data indicates a recovery trajectory. Analysts attribute this rebound to improved corporate earnings reports and a resurgence in tech stocks, which make up a substantial portion of the index, particularly companies like Samsung and SK Hynix.

In October 2023, the index crossed the 3,000 mark, a significant psychological barrier for investors. Factors contributing to this rise include eased inflation rates and positive fiscal policies set forth by the South Korean government aimed at stimulating growth. This performance is encouraging, but experts warn that ongoing global economic uncertainties, such as potential rate hikes by central banks worldwide, could pose risks to future gains.

The Role of the KOSPI Index

The KOSPI Index not only reflects stock performance but also serves as an important indicator of South Korea’s economic health. A strong KOSPI often correlates with consumer confidence and business profitability, while downturns may signal broader economic concerns. Additionally, the index plays a vital role in attracting foreign investment, with many international funds using it as a benchmark for assessing South Korean companies.

Future Outlook

Looking ahead, financial analysts remain cautiously optimistic about the KOSPI Index’s trajectory. The anticipated continued rise in technology and green energy sectors is likely to provide further support. However, geopolitical factors, such as tensions in the Korean Peninsula and global economic slowdowns, could hinder growth. Investors are advised to stay abreast of global market developments and South Korea’s fiscal policies as they assess their investment strategies.

Conclusion

The KOSPI Index remains a vital indicator of South Korea’s financial landscape and broader economic sentiments. Its performance not only affects local investors but also has implications for global markets. For those considering investing in South Korea or seeking to understand the dynamics of Asian markets, monitoring the KOSPI Index is essential. As global uncertainties persist, the index’s response will be closely watched by economists and investors alike.