Current Trends Impacting Idea Share Price

Introduction

The share price of Idea Cellular, a prominent player in India’s telecommunications sector, holds significant relevance for investors and market analysts alike. As one of the key competitors in a rapidly evolving industry, fluctuations in Idea’s share price are indicative of broader market trends, competitive positioning, and consumer behavior in telecommunications.

Recent Developments

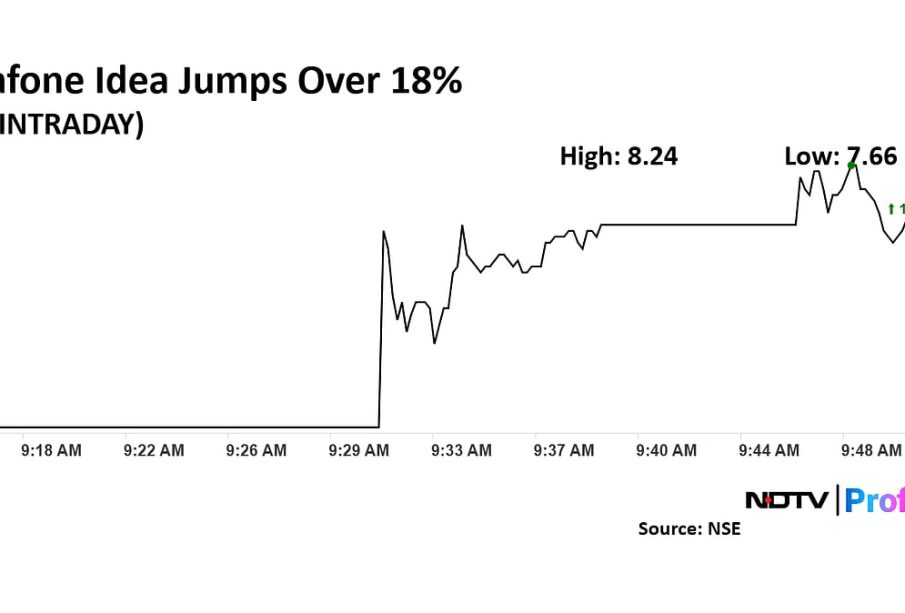

As of October 2023, Idea’s share price has seen notable volatility due to a combination of internal restructuring efforts and external market forces. The ongoing 5G rollout by all major telecommunications companies is creating both opportunities and challenges for Idea. Recently, the stock price was observed trading at ₹10.50, up by 2.5% from the previous week. Analysts attribute this rise to increasing subscriber growth, improving ARPU (Average Revenue Per User), and strategic partnerships aimed at enhancing service delivery.

Factors Influencing Share Price

Several factors contribute to the fluctuations in Idea’s share price:

- Subscriber Growth: Idea reported a 15% increase in subscriber base over the last quarter, which positively impacts revenue forecasts.

- Market Competition: Competition from rivals such as Jio, Airtel, and BSNL continues to pressure pricing strategies, influencing market sentiment regarding Idea’s financial health.

- Policy Changes: New regulations in the telecommunications sector, including spectrum allocation and pricing, can dramatically impact operational costs and profitability.

Investor Sentiment and Future Outlook

Investor confidence in Idea’s long-term prospects remains cautiously optimistic. While the company is focusing on consolidating its market position by offering competitive pricing and expanding its service range, ongoing challenges such as debt obligation and market competition persist. The upcoming quarterly results, set to be released next month, are likely to further shape investor sentiment and could affect the share price dynamics.

Conclusion

The importance of monitoring Idea’s share price cannot be understated, especially in the context of a competitive telecommunications landscape. Current trends suggest potential for growth, but stakeholders should remain aware of market conditions, regulatory impacts, and competitive actions. As investors navigate these complexities, the upcoming financial disclosures will be crucial in determining the future trajectory of Idea’s share price and its overall market position.