Understanding Paytm Share: Market Performance and Insights

Introduction

The performance of Paytm share has garnered significant attention since its Initial Public Offering (IPO) in November 2021. As one of India’s leading digital payment platforms, Paytm’s stock reflects both investor optimism and caution in the rapidly evolving fintech landscape. Understanding the dynamics surrounding Paytm shares is crucial for investors looking to navigate the Indian stock market.

Recent Market Trends

As of October 2023, Paytm’s share price has experienced notable fluctuations. After a critical analysis in early 2023, where the share price dipped to an all-time low, the stock has shown signs of recovery, attributed to increasing user engagement and strategic initiatives taken by the company. Currently, the share is trading around ₹600, a stark contrast to its debut price of ₹2,150.

Key Factors Influencing Paytm Share Movement

- User Engagement: Paytm has reported a significant increase in daily transactions, reaching over 300 million transactions per month. This surge is crucial as it directly impacts profitability and investor confidence.

- Financial Reports: In its latest financial disclosures, Paytm showcased improvements in revenue and reduced losses, suggesting that the company is moving towards a more sustainable business model.

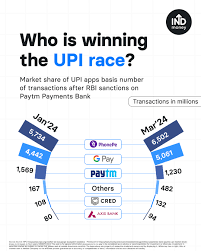

- Market Competition: With a myriad of players in the fintech space, including giants like Google Pay and PhonePe, Paytm continues to innovate its services to retain market share.

Future Outlook

Analysts remain divided on the future of Paytm shares. Some predict a bullish trend, citing growing digital payment adoption in India and expected profitability in the coming quarters. Others warn that regulatory hurdles and intense competition could impact growth. The upcoming earnings report scheduled for November 2023 will be pivotal in determining market sentiment and likely share price revaluations.

Conclusion

For investors, keeping a close watch on Paytm share price movements is essential given the potential for high volatility. New developments in the fintech sector and ongoing strategic initiatives from Paytm may present both opportunities and risks. As digital payments continue to become more prevalent in India, the performance of Paytm shares will serve as a bellwether for the market’s confidence in the fintech industry as a whole.