Understanding the Dow Jones Index and Its Market Impact

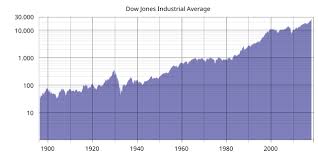

Introduction to the Dow Jones Index

The Dow Jones Index, one of the oldest and most widely recognized stock market indices in the world, serves as a barometer for the overall health of the U.S. economy. Established in 1896, it reflects the performance of 30 significant publicly traded companies, making it a critical indicator for investors and analysts alike. As economic stability fluctuates, the movements of the Dow are closely monitored by market participants worldwide, highlighting its continued relevance in today’s financial landscape.

Current Trends in the Dow Jones Index

As of October 2023, the Dow Jones Industrial Average (DJIA) has shown notable fluctuations amid various economic factors. Recent reports indicate that the index has struggled to maintain a consistent upward trajectory, reflecting investor concerns over inflation and interest rate changes. After reaching a peak earlier this month, market analysts observed a slight pullback due to mixed corporate earnings reports from major constituents like Apple, Goldman Sachs, and Boeing.

Furthermore, geopolitical tensions and uncertainty regarding U.S. monetary policy have contributed to market volatility. The Federal Reserve’s decision to maintain or adjust interest rates in upcoming meetings will play a significant role in guiding investor sentiment. A rise in rates typically results in tighter financial conditions, subsequently affecting stock prices across the board.

Implications for Investors

For investors, the Dow Jones Index serves as an essential tool for assessing market performance and making informed investment choices. Understanding the underlying components and factors affecting the index can aid in tailoring investment strategies. Market watchers suggest that diversification remains a prudent approach, particularly in times of uncertainty. Stocks within the Dow are selected based on criteria such as market capitalization and traded volume, but it’s important to consider macroeconomic conditions that influence their performance.

Conclusion: What Lies Ahead for the Dow Jones Index?

In conclusion, the Dow Jones Index continues to be a vital gauge of financial market trends. As we move towards the end of 2023, the outlook on the index will likely depend on broader economic signals including federal monetary policy, inflation trends, and corporate performance. Investors are advised to stay informed about developments and consider both short-term volatility and long-term growth potential when making investment decisions. Overall, keeping an eye on the Dow Jones Index remains essential for anyone looking to navigate the complexities of the stock market effectively.