Current Trends in Vedanta Share Prices

Introduction

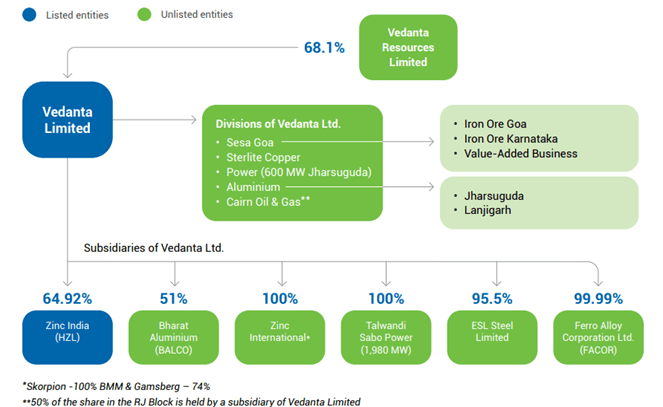

Vedanta Ltd., one of India’s leading natural resources conglomerates, has recently garnered significant attention in the stock market. The company’s shares are pivotal for investors looking to capitalize on the flourishing natural resources sector in India. With its diversified business operations, including oil, gas, zinc, lead, and silver, understanding the movement and performance of Vedanta shares is crucial for both retail and institutional investors.

Recent Developments

As of October 2023, Vedanta shares have seen fluctuations that reflect broader market trends influenced by global commodity prices and domestic economic factors. Over the past month, the stock experienced volatility related to the geopolitical tensions affecting energy prices, along with changes in regulatory policies in the mining sector. On October 15, 2023, Vedanta shares reported a closing price of INR 240, a significant drop from the previous month, attributed to investor concerns over global demand for metals.

Investors are keenly watching Vedanta’s upcoming quarterly financial results, scheduled for late October, which are expected to provide insights into the company’s revenue and profit margins amidst these challenges. Analysts anticipate the results could be a decisive factor for share performance in the coming weeks.

Market Sentiment and Predictions

Market analysts remain divided regarding Vedanta’s future performance. Some posit that if global industrial activity picks up and commodity prices stabilize, Vedanta shares may rebound. Additionally, initiatives by the government to bolster domestic mining and reduce import dependency are likely to provide a favorable backdrop for the company.

On the other hand, potential investors are advised to be cautious due to the ongoing volatility in the raw materials market and regulatory scrutiny that the mining sector faces. Experts emphasize the importance of conducting thorough research and possibly waiting for more stability before making significant investments in Vedanta shares.

Conclusion

In summary, Vedanta shares present both opportunities and risks in the current market landscape. Investors should keep an eye on the upcoming quarterly performance and broader economic indicators to make informed decisions. As Vedanta navigates these challenges, its ability to adapt to market conditions will be critical in defining the outlook for its shares, ultimately affecting investor sentiment and stock valuation.