Update on IRFC Share: Trends and Market Insights

Introduction

The Indian Railway Finance Corporation (IRFC) plays a crucial role in funding the Indian Railways, one of the largest railway networks in the world. Since its listing in January 2021, IRFC shares have attracted significant attention from investors, curious about the company’s role in infrastructure development and its financial performance. With recent fluctuations in stock prices and economic developments impacting the finance sector, understanding the current state of IRFC shares is vital for investors and stakeholders.

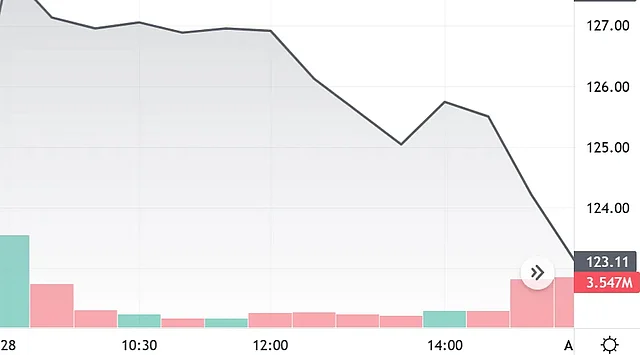

Current Performance of IRFC Share

As of October 2023, IRFC shares have shown a mixed yet cautiously optimistic trend. Currently, the stock is trading around ₹35, reflecting a slight increase from the previous month where it was valued at ₹32. Experts attribute this improvement to a combination of factors, including a steady rise in infrastructure spending by the Indian government and positive sentiments around the railways’ modernization initiatives.

Financial Results

In its latest quarterly earnings report, IRFC reported a revenue growth of 12% year-on-year, driven primarily by higher interest income from loans extended to various branches of Indian Railways. The net profit for the second quarter stood at ₹900 crores, which is a substantial year-on-year increase, indicating robust growth in the finance sector.

Market Sentiment and Trends

Analysts are optimistic about IRFC shares, especially due to the government’s focused initiatives on expanding railway infrastructure under the “National Infrastructure Pipeline”. The introduction of new trains and improvement in existing services is fueling investor confidence. Additionally, with the global green shift gaining momentum, IRFC’s involvement in financing cleaner technologies within railways signifies its alignment with future market trends.

Investment Advice

Market analysts recommend a cautious approach for potential investors. While the fundamentals seem strong, the railway sector can be subject to policy changes and economic factors that might affect stock prices. Long-term investors are encouraged to consider IRFC shares as a viable option, particularly for those looking to invest in an essential utility linked to India’s economic growth.

Conclusion

In conclusion, IRFC shares present a strategic investment opportunity in the current market scenario. With promising financial results, supportive government policies, and significant growth potential, investors may find IRFC shares worthy of closer attention. As the infrastructure development in India continues to evolve, staying informed about shifts in policies and market sentiments will be key to making informed investment decisions.