Current Updates on Godfrey Phillips Share Price

Introduction

Godfrey Phillips India Ltd is one of the leading players in the Indian tobacco sector, known for its diverse product range including cigarettes and other consumer goods. The company’s share price holds significant relevance for investors and market analysts as it reflects the health of the organization and the broader trends in the tobacco industry. Recent fluctuations in the stock market have raised concerns and interests among stakeholders, making it crucial to keep abreast of the current Godfrey Phillips share price and its implications.

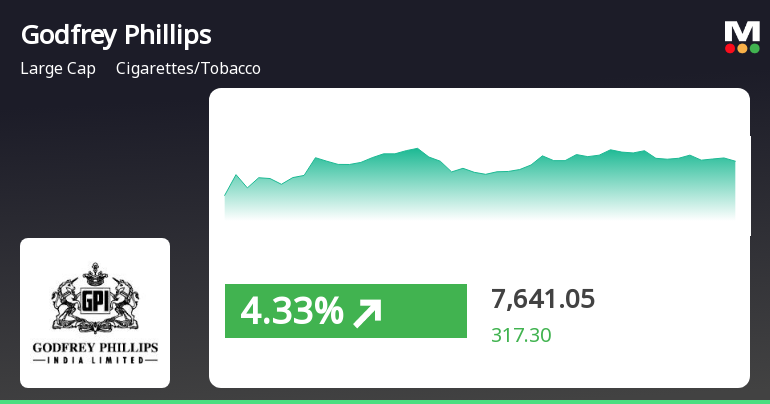

Recent Performance of Godfrey Phillips Share Price

As of mid-November 2023, Godfrey Phillips’ shares have shown a notable increase, trading at ₹1,165 per share, which is approximately a 12% rise from its value in the previous quarter. The ongoing changes can be attributed to various factors including strategic marketing initiatives and the successful launch of new products. Reports indicate that the company has diversified its offerings to include reduced-risk products, which has been positively received in the market. This diversification is bolstered by an increase in demand for alternatives to traditional tobacco products.

Factors Influencing the Share Price

The current trading environment for Godfrey Phillips shares is influenced by various internal and external factors. Internally, the company’s robust financial performance and sustained growth in revenues have contributed positively. Externally, market sentiment surrounding the tobacco industry remains mixed; there are ongoing discussions regarding regulatory changes and health campaigns impacting smoking habits which could affect the long-term outlook for traditional tobacco products.

Additionally, the company’s efforts in enhancing its sustainability practices and community-driven initiatives have boosted its image among socially-conscious investors. Analysts believe that such measures could provide a cushion against potential declines driven by regulatory challenges.

Conclusion

In conclusion, the share price of Godfrey Phillips is currently on an upward trajectory, reflecting the company’s strategic initiatives and favorable market conditions. However, potential investors should remain cautious as market dynamics can shift rapidly due to regulatory changes or shifting consumer preferences. Monitoring trends in the tobacco sector and the company’s quarterly performance will be vital for making informed investment decisions. As Godfrey Phillips continues to evolve within a changing marketplace, the performance of its shares will serve as an important indicator of its strategic success and stability in the industry.