Latest Trends in Ashok Leyland Share Market Performance

Introduction

Ashok Leyland, one of India’s largest commercial vehicle manufacturers, has gained significant attention in the stock market recently. As a flagship company of the Hinduja Group, Ashok Leyland’s performance on the stock exchange is closely watched by investors and analysts due to its substantial impact on the automotive sector and the economy as a whole. Understanding the share movement of such a prominent company is essential for investors seeking opportunities in the manufacturing and transportation sector.

Recent Performance and Key Events

As of October 2023, Ashok Leyland shares have witnessed a notable rise, marking an increase of approximately 15% over the past month. This surge can be attributed to several factors, including robust quarterly earnings reports, an increase in demand for commercial vehicles, and strategic initiatives focused on electric mobility.

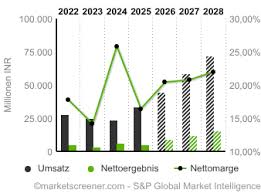

In their latest earnings report, Ashok Leyland reported a revenue increase of 20% year-on-year, driven by higher sales in light and medium commercial vehicles. The global push towards sustainability has also led the company to expand its electric vehicle (EV) offerings, a move that is expected to position it favorably against competitors in the long run.

Market Conditions and Analysis

Analysts suggest that Ashok Leyland’s growth is not only a result of favorable domestic market conditions but also a reflection of its performance in international markets. With increasing exports, particularly to countries in Africa and the Middle East, Ashok Leyland is diversifying its revenue streams. Furthermore, the government’s push for infrastructure development across India is likely to sustain demand for commercial vehicles, benefiting companies like Ashok Leyland.

In addition, various brokerage firms have initiated buy ratings on Ashok Leyland shares, citing strong fundamentals and future growth potential. This positive outlook has encouraged retail investors to increase their holdings in the company, contributing to the rising share prices.

Conclusion

As Ashok Leyland continues to innovate and expand its market presence, its shares present a compelling opportunity for investors interested in the automotive sector. The company’s proactive approach towards embracing electric vehicles and its solid performance indicators signal optimism for future growth.

Investors should keep a close watch on the company’s quarterly results and industry trends as they weigh the potential risks and rewards of investing in Ashok Leyland shares. The ongoing developments in the electric vehicle market and government policies favoring green initiatives could play a crucial role in shaping the company’s performance and, consequently, its share prices in the coming months.