Understanding RVNL Share Price and Market Movements

Introduction

Rail Vikas Nigam Limited (RVNL) has become a significant player in the Indian railways sector by spearheading various infrastructure projects. As a publicly traded company on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), the RVNL share price is closely monitored by investors. The share price serves as a barometer for the company’s growth potential and investor confidence in the Indian infrastructure sector.

Current Market Performance

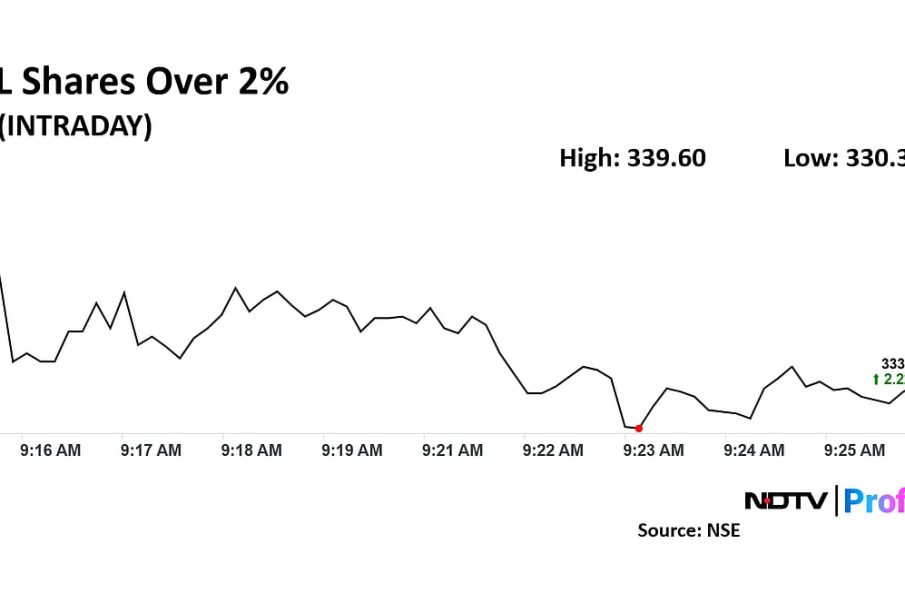

As of October 2023, RVNL’s share price has seen notable fluctuations due to a combination of factors including government policies, ongoing infrastructure projects, and overall market conditions. With the Indian government focusing on enhancing the railway infrastructure, RVNL’s shares have gained traction among investors. According to recent reports, RVNL shares traded at approximately ₹65 per share, reflecting a progressive increase of 10% over the last month. Analysts suggest that this uptick is primarily attributed to the announcement of new railway projects and financing from the government aimed at boosting infrastructure.

Factors Influencing RVNL Share Price

Several external and internal factors significantly impact the RVNL share price:

- Government Initiatives: Recent budget allocations have increased towards the railway sector, bolstering the framework in which RVNL operates.

- Project Completion: Successful execution of projects has ensured steady revenue streams, boosting analyst ratings and investor confidence.

- Market Sentiment: Broader market conditions and investor sentiment towards infrastructure stocks influenced by economic indicators.

Future Outlook

Looking ahead, experts predict a bullish trend for RVNL shares. If the ongoing projects continue to progress without significant delays, RVNL is expected to witness growth in its stock value. The government’s commitment to infrastructure development is likely to yield positive outcomes for RVNL in the long run. However, potential investors should remain aware of market volatility and the implications of economic shifts on their investment strategy.

Conclusion

In summary, the RVNL share price stands as a promising investment opportunity amid the Indian government’s push for railway enhancements. Stakeholders should monitor upcoming announcements regarding project timelines and government expenditures, as these can substantially affect share prices. As infrastructure development remains a key priority, RVNL’s role in transforming India’s transportation landscape becomes ever more critical, providing both challenges and opportunities for investors.