Current Trends in MRF Share Price: An Overview

Introduction

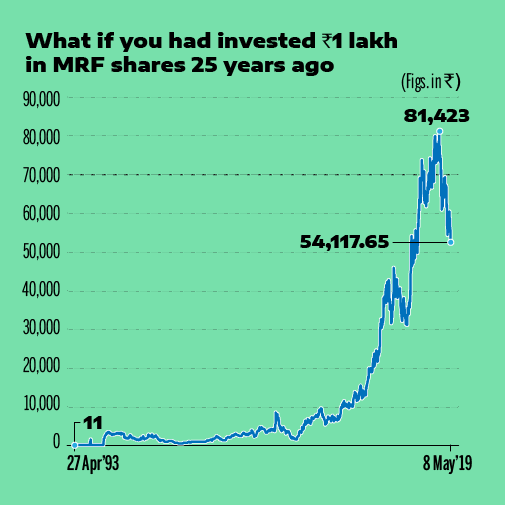

The share price of MRF Ltd., one of India’s leading tire manufacturing companies, has garnered significant attention in the stock market. As the most expensive stock on the BSE, MRF’s share price reflects not just the company’s performance but also broader economic indicators and consumer sentiment. Understanding its price movements is crucial for investors looking to capitalize on opportunities within the automotive and tire sectors.

Recent Trends in MRF Share Price

As of October 2023, MRF share price has seen considerable fluctuations. The latest trading sessions showed the stock hovering around INR 93,000, a slight increase from the previous month. Analysts attribute this rise to strong quarterly results announced in September, which showcased a 12% increase in net profit year-on-year, driven by a surge in demand for commercial tires and expansion into electric vehicle tires.

Market Factors Influencing Share Price

Several external factors have contributed to the recent movement in MRF’s share price. The Indian stock market, influenced by global economic trends, has been experiencing volatility, which also affects investor sentiment towards high-value stocks. Additionally, changes in raw material costs, particularly rubber and petroleum products, directly impact MRF’s profitability, which in turn affects its share price.

Investor Sentiment and Expert Opinions

Investors remain optimistic about MRF’s long-term potential, with many brokerage houses issuing ‘buy’ ratings, citing continuous growth in the automotive sector and plans for diversification into sustainable products. Experts recommend investors to closely monitor market trends and MRF’s strategic initiatives, which could influence its future performance significantly.

Conclusion

The MRF share price serves as a barometer for the health of not just the company but also the broader automotive industry in India. With its robust growth trajectory and ongoing innovations, MRF remains a popular choice among investors. As MRF continues to adapt to changing market conditions and consumer preferences, keeping an eye on its share price will be vital for stakeholders looking to make informed investment decisions.