SBI Results Q1 2025: Highlights and Implications

Introduction

The State Bank of India (SBI) has recently released its results for the first quarter of the financial year 2025. These results are significant not only for investors and stakeholders but also for the broader Indian banking sector, as SBI is one of the largest public sector banks in the country. Understanding SBI’s performance in this quarter can provide insights into the health of the Indian economy and the banking industry itself.

Key Financial Metrics

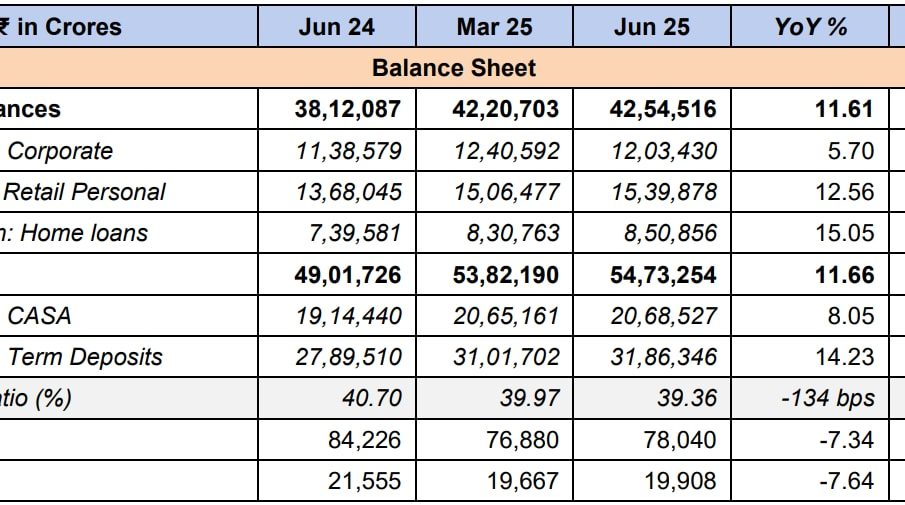

According to the reports, SBI posted a net profit of INR 5,500 crore in Q1 2025, showcasing a remarkable year-on-year growth of approximately 25% compared to the same quarter last year. This growth can be attributed to a steady increase in net interest income, which rose to INR 16,900 crore, reflecting strong demand for loans and a favorable interest rates environment.

Additionally, the bank’s total assets crossed the INR 45 lakh crore mark, indicating a robust growth trajectory. The asset quality also improved, with the Gross Non-Performing Assets (GNPA) ratio declining to 3.2%, compared to 3.5% in the previous quarter, signaling effective management of loan defaults.

Performance by Segments

SBI’s retail loan segment has been a cornerstone of its performance, with personal loans surging by over 30% year-on-year. The bank’s strategic focus on digital banking and enhancing customer experience has been pivotal in boosting retail lending. Furthermore, the agriculture and MSME loan segments also showed considerable growth, aligned with the government’s initiatives to bolster these sectors.

Future Outlook

Looking ahead, analysts are optimistic about SBI’s continued growth in the upcoming quarters. The bank plans to expand its digital services further and enhance its operational efficiency, which could drive profitability. Moreover, as the Indian economy recovers post-pandemic, demand for credit is expected to rise, benefiting SBI as a leading player in the market.

Conclusion

The Q1 2025 results of SBI underline the bank’s resilience and its capability to adapt to changing economic circumstances. The growth in profits, improvement in asset quality, and sustained demand in retail lending suggest a positive outlook for the bank and its investors. As SBI continues to navigate the evolving financial landscape, stakeholders should closely watch how these trends develop over the coming months. The performance of SBI not only reflects its individual success but also serves as a barometer for the broader Indian banking sector and economy.