Trends and Insights on the USD to INR Exchange Rate

Introduction

The exchange rate between the US dollar (USD) and the Indian rupee (INR) is a significant economic indicator, influencing various sectors such as trade, finance, and investment. Recent fluctuations in the USD INR rate have raised concerns among businesses and investors alike, making it imperative to understand the underlying factors affecting this currency pair.

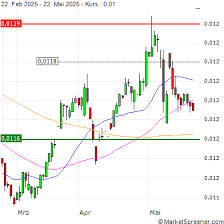

Current Trends in the USD to INR Exchange Rate

As of October 2023, the USD INR exchange rate has been hovering around 83.50. This reflects a gradual increase from earlier this year, when the rate was approximately 81.00. Factors contributing to the rise include the strengthening of the US dollar against a backdrop of robust economic data emerging from the United States, coupled with inflation pressures within India.

According to the Reserve Bank of India (RBI), persistent inflation above the target level has prompted analysts to predict that the RBI may continue to hold interest rates steady or even increase them, thereby exerting upward pressure on the rupee.

Impact on the Indian Economy

The fluctuations in the USD INR rate have significant implications for the Indian economy. A weaker rupee often leads to higher costs for imports, particularly in sectors such as energy and raw materials. Consequently, this may increase the prices of consumer goods, putting pressure on household budgets.

Moreover, a higher USD INR rate can impact foreign investments. While some investors may see it as an opportunity to acquire assets at a lower rupee value, others may feel deterred due to concerns about currency devaluation. Understanding these dynamics is crucial for both domestic and foreign investors as they navigate the Indian market.

Prediction and Outlook

Market analysts predict that the USD INR exchange rate may continue to exhibit volatility in the coming months, depending on global economic conditions and domestic policy responses. Investors are advised to remain vigilant and consider hedging strategies to mitigate potential risks arising from currency fluctuations.

Conclusion

The USD to INR exchange rate is not just a financial statistic; it plays a vital role in shaping the economic landscape of India. As stakeholders monitor the ongoing developments, staying informed about currency movements can aid in making more informed decisions. With global economic recovery, trade partnerships, and monetary policy decisions in play, the importance of understanding the USD INR dynamic will only increase.