Latest Update on IFL Enterprises Share Price

Introduction

The share price of IFL Enterprises has gained significant attention lately due to its remarkable performance in the stock market. As one of the prominent players in the financial services sector, the fluctuation in IFL Enterprises’ share price impacts not only investors but also the overall market sentiment. Understanding the factors influencing the share price can help stakeholders make informed investment decisions.

Recent Performance

As of the latest trading session on October 10, 2023, IFL Enterprises is trading at ₹180 per share, showcasing a notable increase of 5.5% from the previous day’s closing price. This surge follows positive quarterly earnings reports, which revealed a substantial rise in revenue, helping bolster investor confidence. Analysts have praised the company for its strategic moves in diversifying its portfolio, which has evidently paid off, reflecting on its share price performance.

Market Factors Influencing Share Price

Two key factors have contributed to the recent rise in IFL Enterprises’ share price: robust financial results and broader market sentiment changes. The company reported a 25% year-on-year increase in revenue, attributed to enhanced operational efficiency and growing demand in its financial products. Furthermore, the stock market, buoyed by positive global cues, has seen a general uptick, benefiting IFL Enterprises as well. Additionally, renewed interest from institutional investors has created buying pressure, driving prices higher.

Investor Sentiment and Future Outlook

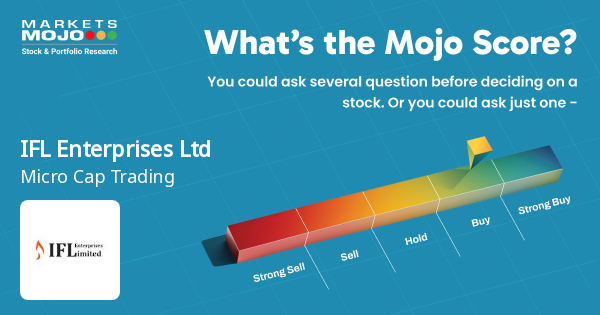

Investor sentiment remains bullish as analysts predict that continued profitability and market expansion could lead to further growth in share prices. Some experts suggest a target price of ₹210 for the coming months based on projected earnings and market conditions. However, they also caution investors about inherent market volatility and recommend that they stay informed about global economic trends that may affect local markets.

Conclusion

FOR current shareholders, the recent surge in IFL Enterprises’ share price is encouraging, but new investors should conduct due diligence before entering the market. As financial performance continues to unfold, the company’s ability to maintain positive momentum in its share price will largely depend on ongoing operational strategies and external market conditions. Investors are advised to monitor developments closely and adjust their strategies as necessary to capitalize on potential growth opportunities.