Adani Power Share: Current Trends and Future Outlook

Introduction

Adani Power, a part of the Adani Group, is one of the largest private power producers in India. The company’s shares have been a subject of significant interest among investors and analysts, especially in light of the recent performance and developments within the renewable energy sector. Understanding the dynamics of Adani Power shares is crucial for both current and potential investors as they navigate the complexities of the Indian stock market.

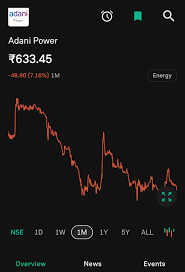

Recent Performance

As of October 2023, Adani Power shares have shown a mixed performance amid rising concerns about the overall economic landscape. Following a wave of scrutiny over the Adani Group’s financial practices in early 2023, the stock saw fluctuations that caught the attention of both individual and institutional investors. Currently, the share price hovers around INR 220, reflecting a notable recovery from its lows earlier in the year. With various analysts offering optimistic projections, many have set target prices considerably higher, suggesting potential gains from current levels.

Market Factors Influencing Adani Power Shares

Several factors are influencing the price movements of Adani Power shares. First, the government’s increasing focus on renewable energy can benefit companies like Adani Power, which has been investing heavily in solar and wind energy projects. Secondly, the company’s aggressive growth strategy, which includes expanding its power generation capacity and diversifying energy sources, has been pivotal in attracting investor confidence.

Moreover, the broader trends in the energy market, including fluctuating coal prices and policies promoting renewable energy adoption, further impact stock performance. The company has also been navigating regulatory challenges, which, while introducing some volatility, may ultimately streamline operations and enhance market positions.

Analysts’ Recommendations

Analysts’ views on Adani Power shares vary, but many suggest a cautious yet optimistic approach. Some financial experts recommend accumulating shares during dips, considering the long-term growth potential tied to India’s increasing power demands and the gradual transition to greener energy sources. Others urge investors to be wary of the regulatory landscape and inherent market risks.

Conclusion

In conclusion, Adani Power shares present a compelling opportunity for investors willing to navigate the challenges and volatility associated with the energy sector. With a backdrop of increasing focus on renewable energy and potential government support, Adani Power is poised for growth. However, investors should remain informed about market dynamics and company developments to make well-informed investment decisions. Looking ahead, the strategic direction of the company coupled with external market conditions will remain critical in shaping the future performance of Adani Power shares.