Greaves Cotton Share: Performance and Future Outlook in 2023

Introduction

Greaves Cotton, a well-known name in the Indian manufacturing landscape, is primarily involved in the production of engines, pumps, and auto components. The performance of its shares is significant not only for investors but also for the broader economic landscape, reflecting investor sentiment and market trends. Recently, Greaves Cotton has attracted attention due to its innovative product lines and business realignment, raising questions about its future in the capital markets.

Recent Share Performance

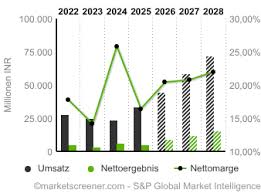

As of October 2023, Greaves Cotton shares have shown considerable volatility, with a current market price hovering around ₹150, reflecting a year-to-date increase of approximately 15%. The company’s focus on diversification into electric mobility solutions and enhanced engine manufacturing has bolstered investor confidence. Institutional investors have shown increased interest, resulting in strong demand during recent trading sessions.

The share rallied following the release of the company’s Q2 financial results, which exceeded market expectations. Greaves Cotton reported a 20% increase in revenue compared to the previous quarter, driven by solid performance in its automotive segment, particularly in electric vehicles (EV) and components. The management has indicated strong order backlogs that promise growth opportunities ahead.

Strategic Initiatives and Market Position

To bolster its market share, Greaves Cotton has been actively pursuing strategic initiatives, including partnerships and acquisitions aimed at enhancing its technological capabilities. The recent acquisition of an EV start-up has positioned the company well within the rapidly growing electric vehicle sector. Industry analysts believe this move could be pivotal in attracting a younger demographic of consumers and investors.

The company is also focusing on sustainability, which aligns with global trends toward environmentally friendly technologies. They are investing in green technologies which can significantly reduce operational costs and improve overall efficiency.

Conclusion

The future outlook for Greaves Cotton shares remains positive as they continue to innovate and adapt to shifting market demands. With increased interest in electric mobility, along with solid financial performance, the company’s shares could present a promising investment opportunity. Investors should keep an eye on the upcoming quarterly reports and the company’s strategic movements in the EV space. As the Indian market continues to evolve, Greaves Cotton is likely to remain a significant player, reflecting broader trends in manufacturing and sustainability.