Insight into Apar Industries Share: Current Trends and Performance

Introduction

Apar Industries Limited, a leading player in the manufacturing and distribution of conductors, cables, and specialty oil, has become a focal point for investors and market analysts. With its robust performance and innovative approaches, the company’s shares have garnered attention on stock exchanges. Understanding the dynamics of Apar Industries share can provide valuable insights into market trends and investment opportunities.

Current Performance

As of late October 2023, Apar Industries shares have shown a steady upward trajectory, with a significant increase of approximately 15% over the past three months. This growth is attributed to the company’s diversification strategy, particularly in the renewable energy sector, which has gained momentum amidst rising demand for sustainable solutions.

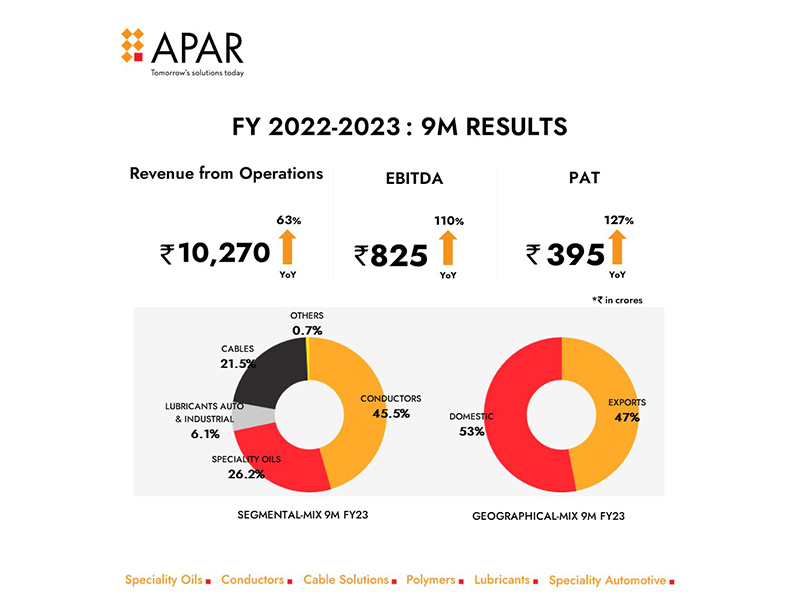

In the latest quarterly report, the company reported a 25% increase in revenue year-on-year, reflecting robust sales across all segments. The successful launch of new products in electric vehicle (EV) infrastructure has also contributed positively, highlighting Apar’s commitment to innovation. Analysts predict continued growth, driven by strong order books and expanding market presence.

Market Analyst Insights

Market analysts’ sentiments on Apar Industries remain bullish, with many highlighting the potential for further gains as the company capitalizes on infrastructure projects across India. The government’s initiatives towards electrification and renewable energy projects positioned Apar as a key player in catering to this expanding market.

Experts have set a target price for Apar Industries shares, estimating it could reach ₹1,150 to ₹1,200 in the coming six months, contingent on the continuity of favorable market conditions and the company’s performance.

Conclusion

The outlook for Apar Industries share remains promising, buoyed by the company’s strategic direction in an evolving market landscape. Investors should monitor the company’s regular updates and industry developments closely. With ongoing advancements in technology and infrastructure within the country, Apar Industries could potentially provide both stability and growth for investors. Keeping an eye on market trends and expert analyses will be essential for anyone looking to understand the dynamics surrounding Apar Industries share in the near future.