Latest Trends in Nestlé India Share Price

Introduction

Nestlé India, a leading player in the food and beverage sector, has been a topic of interest for investors as its share price reflects the company’s performance and market trends. Understanding the fluctuations in its share price is crucial for potential investors and stakeholders as it provides insights into the company’s health, market confidence, and overall economic conditions.

Current Share Price Performance

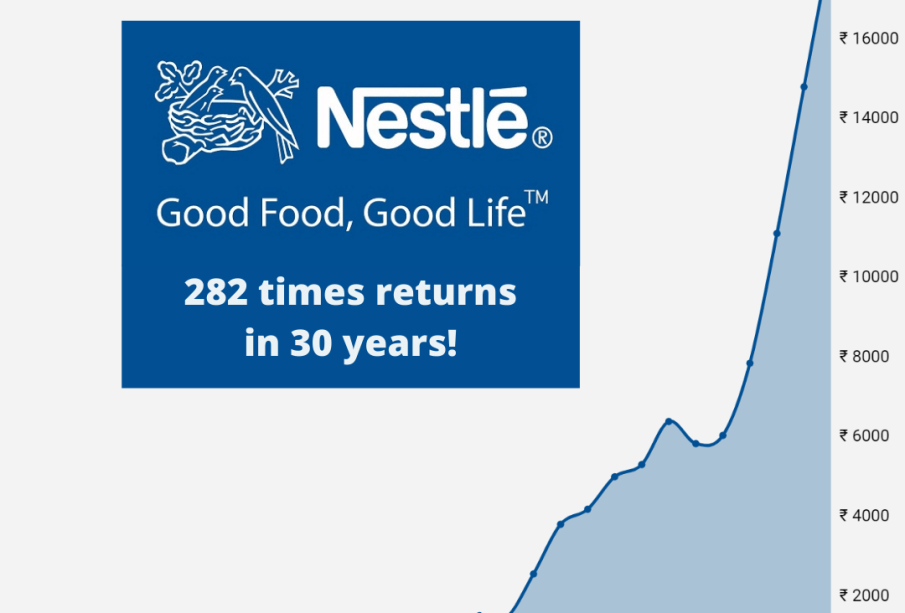

As of October 2023, Nestlé India’s share price has shown significant fluctuations. Currently, the share price is hovering around ₹19,000 per share, reflecting a gradual increase of approximately 4% over the last three months. Investors are keenly observing the stock’s performance following the company’s recent announcement of an increase in its product prices due to rising raw material costs, which is expected to bolster profit margins in the upcoming quarters.

Factors Influencing the Share Price

Several factors contribute to the ongoing fluctuation in Nestlé India’s share price. First, the quarterly financial results, which showed an impressive growth in revenue driven by strong demand for its key products like Maggi noodles and Nescafé coffee, have positively impacted investor sentiment. The company’s commitment to sustainable practices and innovative product launches also play a significant role in enhancing its market position.

Moreover, the overall stock market trends, influenced by economic indicators and investor confidence, also affect Nestlé’s share price. The recent bullish trends in the Indian stock market have helped companies like Nestlé India gain traction among investors seeking stability in volatile times.

Investor Insights and Future Outlook

Market analysts suggest that Nestlé India presents a stable investment opportunity, especially with its ongoing initiatives to diversify its product range and expand its reach in the health and wellness segments. Despite the challenges posed by inflation and supply chain disruptions, the company’s robust business model and established brand reputation suggest that it may continue to grow in the long term.

Furthermore, as consumers increasingly focus on health and nutrition, Nestlé’s strategic focus on healthier options is likely to attract more consumers and, consequently, investors. Analysts predict that if current trends continue, Nestlé India’s share price could see a further increase, backed by solid performance in its core product lines.

Conclusion

In conclusion, understanding the trends in Nestlé India’s share price is essential for investors looking to capitalize on market movements. With a favorable outlook and continuous innovativeness, Nestlé India is poised to remain a key player in the Indian market, making it a compelling option for both current and prospective investors. The company’s proactive strategies and resilience in the face of challenges will likely position it well for future growth.