Coforge Share Price: Latest Update and Market Trends

Introduction

The share price of Coforge, a leading global IT service provider, has become a focal point for investors and market analysts alike. As businesses increasingly rely on digital transformation, understanding the dynamics of Coforge’s stock performance is critical for stakeholders. This article delves into the recent trends in Coforge’s share price, shedding light on its significance in the current economic climate.

Current Market Performance

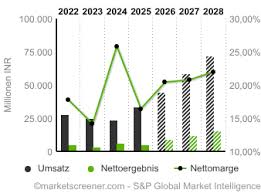

As of October 2023, Coforge’s share price has shown notable volatility, reflecting broader market conditions influenced by global economic shifts and industry-specific developments. As reported on major financial news platforms, the share price fluctuated between INR 4,200 to INR 4,500 over the past month. This fluctuation is attributed to various factors including changes in demand for IT services, corporate earnings, and investor sentiment.

Recent Developments Influencing Share Price

One significant trigger for the recent fluctuations in Coforge’s share price has been its quarterly earnings report, wherein the company registered a growth of 15% in revenue compared to the same quarter last year. Analysts have noted that this growth is indicative of the increased reliance on IT services post-pandemic, aligning with global trends towards digitalization.

Additionally, strategic partnerships and acquisitions have also played a crucial role in shaping investor perceptions. In recent months, Coforge has announced collaborations with key players in the financial technology sector, further fueling market optimism regarding its future growth prospects.

Investor Sentiment and Analyst Forecasts

Market sentiment has generally been positive, with analysts suggesting a bullish outlook for Coforge. Many financial experts expect that continued investment in cloud computing and artificial intelligence will bolster the company’s market position, likely enhancing share price stability in the long run. According to recent analyst reports, projections for Coforge’s share price over the next year average around INR 4,800 to INR 5,200, contingent on sustained revenue growth and market conditions.

Conclusion

The performance of Coforge’s share price is a reflection of its strategic efforts and the shifting landscape of the IT services industry. For current and potential investors, keeping abreast of market trends, earnings reports, and external economic factors will be essential in making informed decisions. Although some volatility is expected, the overall outlook for Coforge remains promising as digital transformation continues to drive demand for its services.