Understanding the Hang Seng Index: Trends and Impact

Introduction to the Hang Seng Index

The Hang Seng Index (HSI) serves as a barometer of the Hong Kong stock market, representing the performance of the largest and most liquid companies traded on the Hong Kong Stock Exchange. As an important indicator, it reflects economic conditions and investor sentiment in both local and global markets. In recent weeks, the HSI has drawn considerable attention due to various factors affecting equity markets worldwide.

Recent Performance and Economic Impact

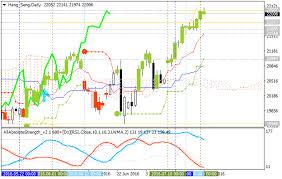

In the first quarter of 2024, the Hang Seng Index has experienced a volatile trading environment, characterized by fluctuations that mirror macroeconomic trends. As of the latest reports, the index is hovering around the 21,000 mark, reflecting a slight decline from the previous year. Economic indicators suggest that persistent inflation and geopolitical tensions, particularly relating to the U.S.-China relations, have heightened market uncertainty.

Additionally, policy decisions from key players, including the People’s Bank of China, to stimulate the economy through monetary easing have also been pivotal. Such measures have led to an influx of liquidity, which, while beneficial, has faced skepticism from investors who remain cautious about the sustainability of growth amidst global economic pressures.

Sector Analysis

A closer look at the sectors represented in the HSI reveals that technology and financial sectors remain a mixed bag. Tech giants like Tencent and Alibaba have seen stock price movements in response to regulatory adjustments and market demand, significantly affecting the index’s performance. On the other hand, the property sector, plagued by debt concerns and policy crackdowns, continues to struggle, casting a shadow over the broader index.

What Lies Ahead for Investors?

Looking ahead, analysts predict that the Hang Seng Index might recover if the global economic outlook stabilizes and if investor confidence improves through easing tensions in trade relations. According to financial analysts, the index could rally if there are positive earnings reports from listed companies and continued support from the Chinese government in terms of fiscal measures.

The significance of monitoring the HSI cannot be overstated as it not only impacts investors based in Hong Kong but also those looking to engage with Asian markets more broadly. With China’s economy showing signs of resilience, the index will serve as a crucial gauge for future investment strategies.

Conclusion

In conclusion, the Hang Seng Index remains a vital indicator of market health and investor sentiment in the Asian financial landscape. As we move deeper into 2024, understanding its dynamics will be essential for investors and market watchers alike. The coming months will likely clarify the trajectory of the index, with ongoing developments in global economics and local policies shaping its future.