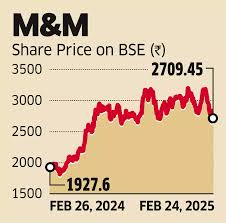

Understanding M&M Share Price Movements

Introduction to M&M Share Price

The share price of Mahindra & Mahindra (M&M), one of India’s leading automotive manufacturers, holds significant importance for investors and market analysts alike. As a major player in the automobile sector, M&M’s performance often reflects broader market trends and economic conditions. Understanding the dynamics influencing its share price can provide valuable insights for both long-term and short-term investors.

Recent Trends in M&M Share Price

In the past month, M&M’s share price has shown a mixture of volatility and resilience. As of October 2023, the share price is hovering around ₹1,450, representing a slight increase of 2.5% from the previous month. Factors contributing to this stability include robust sales figures in the SUV segment, strong demand for electric vehicles (EVs), and positive investor sentiment fueled by the company’s ambitious expansion plans.

Analysts have pointed to several significant developments influencing M&M’s stock performance. The company recently announced a strategic partnership with several technology firms to enhance its EV lineup, aimed at capturing a larger market share in the green mobility sector. This move has garnered positive reactions from investors, as the EV market is expected to witness substantial growth in India, driven by both consumer demand and government incentives.

Market Analysis and Future Outlook

According to industry experts, the outlook for M&M’s share price remains optimistic. With upcoming product launches in both the conventional and electric segments, coupled with increasing market penetration, the company is well-positioned for growth. However, it is essential to note potential risks, including supply chain disruptions and competition from both domestic and international players. Analyst recommendations currently vary, with some predicting a price target of ₹1,600 within the next 6 to 12 months, while others urge caution given the fluctuating economic context.

Conclusion

The M&M share price is not only an indicator of the company’s health but also a reflection of the wider automotive industry outlook in India. Investors should continue to monitor market trends closely, considering both M&M’s strategic initiatives and broader economic signals. As the automotive sector adapts to changing consumer preferences and advancements in technology, the movements of M&M’s share price will likely remain a focal point for investors and analysts in the coming months.