Understanding the Nikkei 225: Japan’s Key Stock Market Index

Introduction to Nikkei 225

The Nikkei 225, often referred to simply as the Nikkei, is Japan’s foremost stock market index, representing the performance of 225 leading companies listed on the Tokyo Stock Exchange (TSE). As an important indicator of Japan’s economic health and a vital component of the global financial system, understanding the Nikkei 225 is crucial for investors and analysts alike.

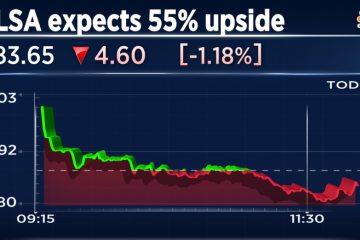

Recent Performance Trends

As of October 2023, the Nikkei 225 has shown significant volatility, reflecting both local and global economic factors. Recent weeks have seen a rebound in consumer confidence, leading to a slight increase in the index. In August 2023, the Nikkei 225 reached its highest level in over three decades, primarily driven by strong corporate earnings reports and easing fears regarding inflation. Analysts suggest that the index’s trajectory will significantly depend on global economic conditions, particularly the policies of central banks and international trade dynamics.

Factors Influencing the Nikkei 225

The Nikkei 225 is influenced by various factors, including domestic economic data, geopolitical tensions, and the performance of multinational companies. For instance, fluctuations in the U.S. dollar against the yen can lead to significant changes in the index. Additionally, Japan’s economic policies, particularly those related to monetary easing and fiscal stimulus, play a critical role in shaping market expectations.

Global Impact of the Nikkei 225

Given Japan’s position as one of the world’s largest economies, movements in the Nikkei 225 often set the tone for global market trends. As many international investors keep a close eye on Japan, changes in the index can influence investment strategies worldwide. For example, a rise in the Nikkei typically encourages greater investment in Asian markets, whereas a downturn might send ripples across global stock exchanges.

Conclusion and Future Outlook

Looking ahead, analysts predict that the Nikkei 225 will continue to experience fluctuations based on both regional and global factors, including the ongoing geopolitical tensions and changes in international trade policies. Investors are advised to stay vigilant and consider the broader economic context when making investment decisions related to the Nikkei 225. Overall, this index not only serves as a barometer for Japan’s economy but also acts as a critical signal for global financial markets.