Current Trends in AMD Share Price and Market Impact

Introduction

The share price of AMD (Advanced Micro Devices, Inc.), a key player in the semiconductor industry, is a significant indicator of the company’s performance and market sentiment. As demand for semiconductor products rises globally, understanding AMD’s share price movements is crucial for investors and stakeholders. Recent fluctuations in AMD’s stock offer insights into its operational strategies and the broader market conditions affecting technology firms.

Recent Performance

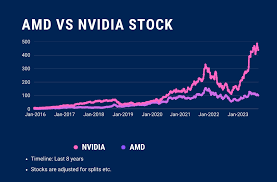

As of October 2023, AMD’s share price has witnessed notable volatility largely influenced by shifts in market demand, technological advancements, and competition from rivals such as NVIDIA and Intel. Analysts report that AMD’s stock fell approximately 5% over the last month, reflecting concerns about slowing growth in the graphic processor segment. At the same time, positive news regarding the launch of its new high-performance chips has generated optimism among investors.

Factors Influencing Share Price

Several factors are currently influencing AMD’s share price. First, semiconductor shortage scenarios are gradually improving, but lingering supply chain challenges still hold back potential growth and profitability. Secondly, the increasing demand for AI and cloud computing solutions is boosting sales of AMD’s CPUs and GPUs, which is expected to improve earnings in upcoming quarters. Furthermore, recent strategic partnerships and collaborations reinforce AMD’s position in the market, potentially stabilizing stock prices.

Market Outlook

Market analysts predict that if AMD can successfully navigate the ongoing industry challenges and capitalize on emerging technologies, its share price may see a rebound. The anticipated release of new product lines in early 2024 is a focal point that could excite investors and analysts alike. Moreover, as more companies revise their tech spending plans amidst an ongoing recovery from the pandemic, AMD is well-positioned to capture market share in various sectors.

Conclusion

The fluctuations in AMD’s share price are crucial not only for investors but also for those monitoring technological advancements and their implications. As the semiconductor industry evolves, AMD’s strategies, market performance, and innovations will significantly shape its future. Stakeholders should remain vigilant and informed about market trends to understand the potential long-term benefits of investing in AMD shares.