Current Trends in Biocon Share Price: An Analysis

Introduction

The share price of Biocon, a leading biopharmaceutical company in India, has garnered attention from investors and analysts alike. As a significant player in the biotechnology sector, the fluctuations in Biocon’s share price can indicate broader market trends in healthcare and pharmaceutical stocks. Understanding the factors influencing its price is crucial for investors and industry observers.

Current Share Price Performance

As of October 2023, Biocon’s shares have experienced notable volatility due to various external and internal factors. The share opened at INR 400 on the National Stock Exchange (NSE) but has shown a steady decline to around INR 350 during the past few weeks. This drop is primarily attributed to a combination of factors including market corrections, recent financial results, and global supply chain challenges that have affected the pharmaceutical industry.

Impact of Recent Earnings Reports

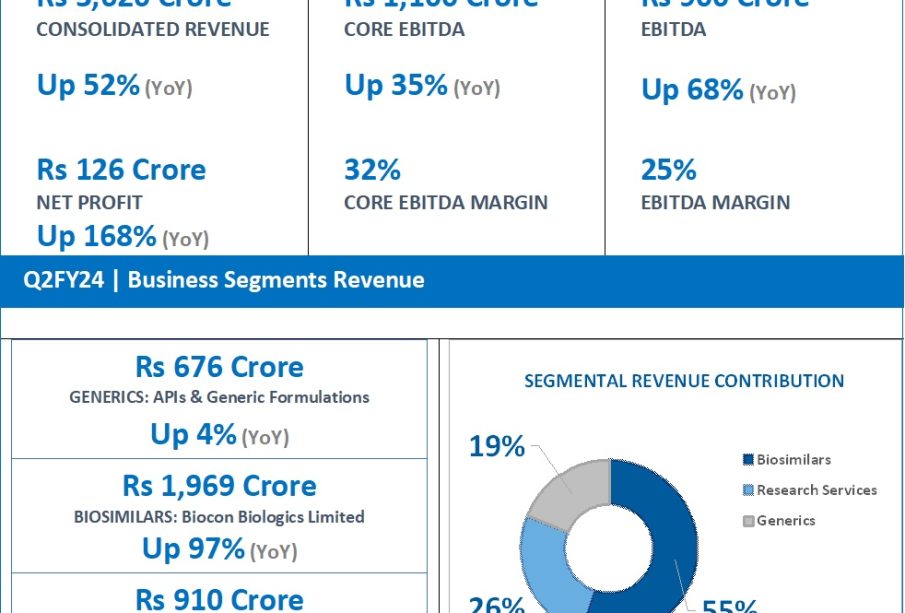

In its latest quarterly earnings report, Biocon announced a revenue growth of 10% year-on-year, reaching INR 2,000 crores. However, the profit margins witnessed a slight reduction due to increased research and development costs and market competition. Analysts predicted that the financial performance would impact investor sentiment, leading to fluctuations in the share price as traders reassess the stock’s valuation.

Market Sentiment and Investor Response

Market sentiment surrounding Biocon remains cautiously optimistic. On one hand, the company has essential partnerships and an expanding product pipeline that promise future growth; on the other hand, short-term volatility may deter risk-averse investors. Analysts suggest that investors should closely monitor developments within the company and the broader market conditions.

Future Outlook

Looking ahead, experts predict that the Biocon share price could rebound if the company successfully launches its new drug therapies and manages to capitalize on emerging markets. The growing demand for biosimilars and innovative drug treatments in regions like Asia and Africa presents significant growth opportunities. However, investors should also be mindful of the ongoing geopolitical uncertainties and their potential impact on stock prices.

Conclusion

The Biocon share price is a reflection of not only the company’s business health but also market dynamics within the pharmaceutical industry. While current trends show a downward movement, the long-term outlook remains positive due to the company’s strong fundamentals. Investors are encouraged to analyze both current market conditions and company performance closely to make informed decisions.