Latest Insights into Biocon Share Price Trends

Introduction

The share price of Biocon, a leading biopharmaceutical company in India, has gained significant attention from investors and analysts alike. In recent years, Biocon has emerged as a prominent player in the biopharmaceutical sector, known for its innovative therapies and global reach. The volatility of its share price is crucial for understanding the company’s market position and potential growth. As of now, the stock is subject to fluctuations influenced by various factors, including market conditions and company performance.

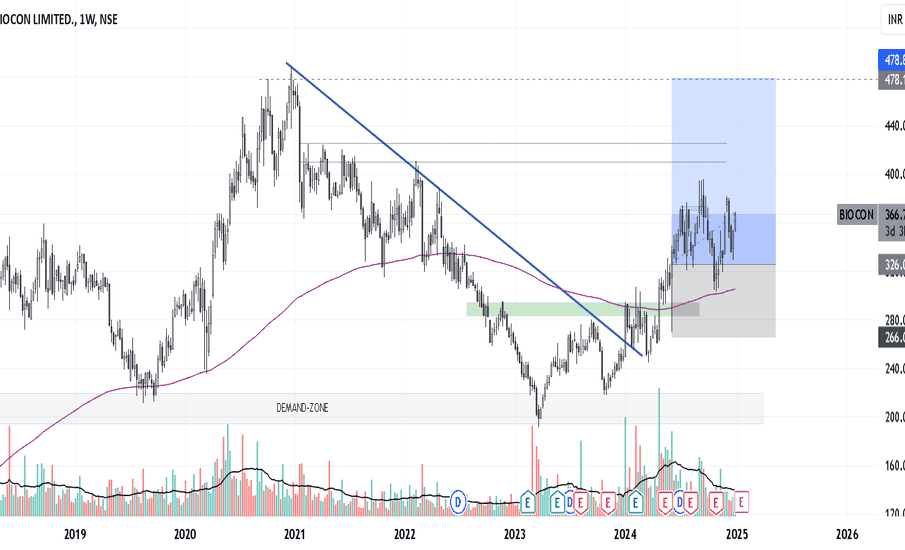

Current Share Price Trends

As of the latest trading sessions, Biocon’s share price has seen notable movements. On October 25, 2023, Biocon’s shares traded at INR 407.50, reflecting a marginal increase of 1.5% from the previous close. The stock’s performance can be attributed to a series of positive quarterly earnings, which showcased a robust revenue growth of 18% year-on-year. Analysts predict that should the company maintain its growth trajectory, the share price could witness further upward movement.

Factors Influencing Biocon’s Share Price

Several factors contribute to the fluctuations in Biocon’s share price:

- Financial Performance: Biocon’s quarterly results play a pivotal role in shaping investor sentiment. The recent earnings report highlighted strong sales in its biosimilars segment, particularly in the US and European markets.

- Market Conditions: The broader market trends and investor confidence in the pharmaceutical sector also influence Biocon’s share price. Global concerns regarding drug pricing and regulatory challenges can lead to volatility.

- Product Pipeline: Biocon’s ongoing research and the development of new therapies, especially in oncology and diabetes care, contribute significantly to its growth potential and, consequently, its share price.

Future Outlook

Looking ahead, analysts remain cautiously optimistic about Biocon’s share price prospects. The company’s strong product pipeline, combined with strategic partnerships and expansion into new markets, positions it well for future growth. However, potential risks such as regulatory hurdles and competition in the biopharmaceutical industry could pose challenges. It is essential for investors to keep an eye on upcoming earnings reports and market developments that may impact Biocon’s stock performance.

Conclusion

In summary, Biocon’s share price remains a focal point for investors navigating the biopharmaceutical landscape. With its recent performance and growth strategies, the company seems poised for a promising future; however, it is vital to approach investments with caution, considering the inherent risks in the sector. Regular updates and analyses will be crucial for making informed investment decisions regarding Biocon shares in the coming months.