Understanding HUL Share Price: Trends, Analysis, and Outlook

Introduction

Hindustan Unilever Limited (HUL) is one of India’s largest consumer goods companies, and its share price is closely watched by analysts and investors alike. Changes in HUL’s share price can indicate broader market trends and consumer behavior, making it an important metric for both professional investors and everyday trade enthusiasts. As the company continues to expand its portfolio with sustainable practices, understanding the HUL share price becomes increasingly relevant.

Current Market Performance

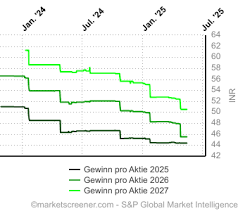

As of the latest reports, HUL’s share price has shown significant fluctuations, reflecting the responses to its quarterly earnings report released last week. The company’s profit rose by 12% year-on-year, but market reactions were mixed due to rising input costs and increased competition within the sector. HUL’s share price is currently trading at approximately ₹2,700, down from its peak of ₹2,800 recorded earlier this year.

Drivers of HUL Share Price

Several key factors influence the share price of HUL. These include:

- Quarterly Earnings: Consistent performance in revenue growth and profitability significantly boosts investor confidence.

- Market Sentiment: Fluctuating consumer trends and market conditions can lead to rapid changes in share prices.

- Raw Material Costs: A rise in commodity prices can squeeze profit margins and impact share performance.

- Regulatory Changes: New regulations in the consumer goods sector can pose risks or opportunities, affecting HUL’s stock valuation.

Recent Developments

Additionally, HUL’s recent focus on sustainability and introducing new product lines, such as plant-based products and eco-friendly packaging, aligns with global consumer trends and may give it a competitive edge, thereby positively influencing its share price in the long run.

Conclusion

The outlook for HUL’s share price remains cautiously optimistic. Analysts suggest that while short-term fluctuations are expected, especially amid diverse market challenges, long-term prospects could improve due to strategic product innovation and strong brand loyalty. Investors are encouraged to stay updated on market trends and corporate developments, as these will continue to play a pivotal role in shaping the future trajectory of HUL’s share price.