Analysis of Tesla Share Price Trends and Future Outlook

Introduction

The Tesla share price has been a significant topic in financial markets, as the company’s innovative approach to electric vehicles has generated immense investor interest. Understanding the fluctuations and trends of Tesla’s shares is essential, as it reflects the company’s growth potential and market positioning amidst intense competition in the automotive sector.

Current State of Tesla Share Price

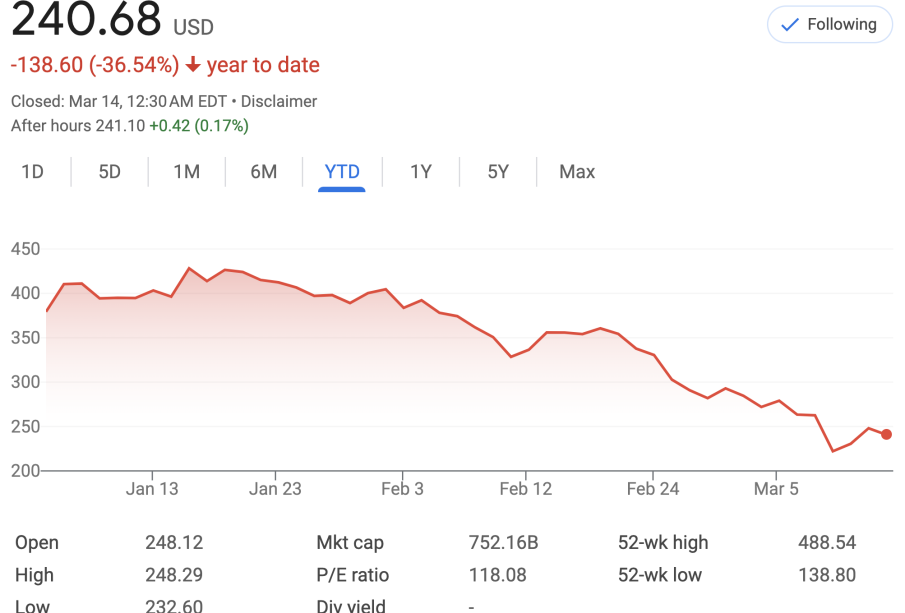

As of mid-October 2023, Tesla’s share price stands at approximately $240, reflecting a 12% decline from its peak earlier this year. This decrease can be attributed to several factors including inflation concerns, interest rate hikes, and increased scrutiny over the company’s production capabilities. Despite these hurdles, Tesla remains a leader in the electric vehicle market with a robust sales outlook, particularly in growing markets like China and Europe.

Recent Developments Affecting Share Price

Interestingly, Tesla’s quarterly earnings report, released last week, surprised investors with a better-than-expected profit of $1.5 billion. This positivity was largely driven by an increase in deliveries and the expansion of the Gigafactory in Berlin, positioning the company favorably for future demand. However, the share price showed only a modest response due to broader market uncertainties. Analysts are also paying close attention to the company’s advances in AI and autonomous driving technology, which could significantly impact long-term valuations.

Market Predictions

Experts predict a cautious outlook for Tesla share price in the short term, with a target range hovering between $220 and $260 by the end of 2023. Factors that could contribute to a rebound include any positive news regarding new model launches, successful scaling of production capacity, and further developments in battery technology. Additionally, growing governmental support for electric vehicles across the globe continues to fuel Tesla’s market opportunities.

Conclusion

The Tesla share price remains a critical barometer for investors seeking to gauge the company’s performance amidst external challenges. While recent fluctuations have raised concerns regarding future growth, the underlying fundamentals of Tesla’s operations and market position remain strong. As the company continues to innovate and expand, the potential for recovery and growth in share price exists, calling for careful monitoring from both long-term investors and market analysts.