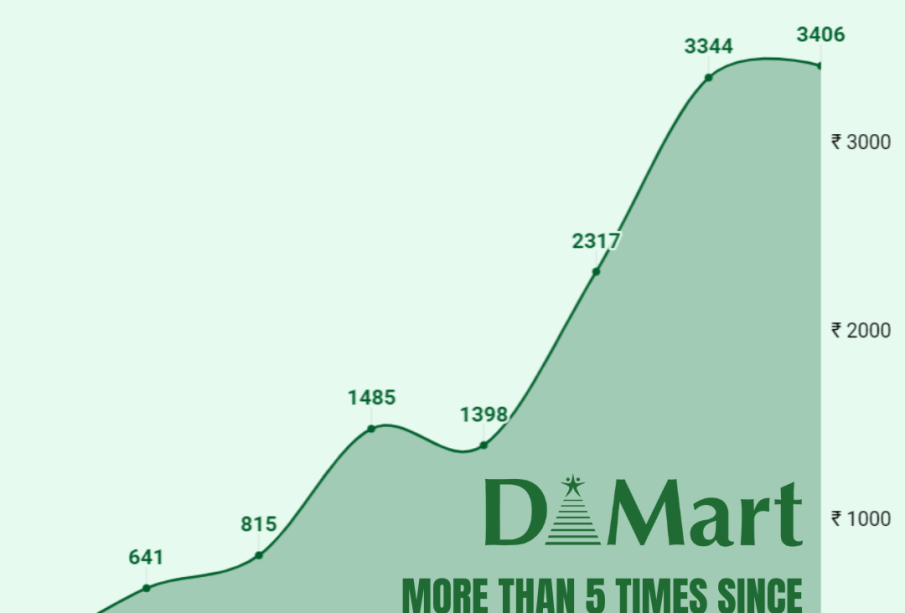

Latest Trends and Insights on D-Mart Share Price

Introduction

D-Mart, officially known as Avenue Supermarts Ltd., is one of India’s leading retail chains, known for its bulk discount model and wide range of products. Its share price is a focal point for investors and analysts, reflecting the company’s market performance and consumer behavior trends. The fluctuation of D-Mart shares in the stock market not only affects individual investors but also serves as a barometer for the retail industry’s health in India post-pandemic.

Current Market Performance

As of mid-October 2023, D-Mart’s share price is hovering around INR 4,100, marking a slight decline of about 2% from the previous month. This dip can be attributed to various factors including inflationary pressures and competitive market dynamics. Analysts note that while D-Mart has a solid business model and strong brand loyalty, it must navigate challenges such as rising costs and changing consumer purchasing patterns.

Recent Developments Affecting Share Price

In the latest earnings report, D-Mart announced a 15% increase in revenue year-on-year, showcasing resilience amidst current economic conditions. However, the profit margins narrowed slightly due to increased operating costs. Investors reacted cautiously to this news, leading to fluctuations in the stock price.

Additionally, D-Mart has been expanding its store footprint across India, with plans to open several new locations in tier 2 and tier 3 cities. This expansion strategy is viewed positively by analysts, as these markets have shown robust demand for organized retail shopping.

Investor Sentiment and Forecast

The overall sentiment among analysts remains cautiously optimistic. While there are short-term challenges, including competition from both local and international players, many agree that D-Mart’s strong fundamentals and market position will help it rebound in the long term. Price forecasts suggest that if the company continues its growth trajectory, the share price could reach upwards of INR 4,500 by the end of the fiscal year.

Conclusion

In conclusion, while the current D-Mart share price reflects a cautious market environment, investors and analysts believe in the company’s long-term potential. The expansion into underserved markets and the commitment to maintaining low prices are expected to support future growth. As the retail landscape evolves, stakeholders will need to stay attuned to market developments to make informed investment decisions.