Understanding KOSPI: South Korea’s Major Stock Index

Introduction

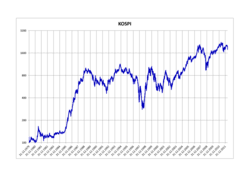

The KOSPI, or the Korea Composite Stock Price Index, functions as South Korea’s primary stock market index, pivotal for gauging the health of the country’s economy. Tracking the performance of the country’s top companies, the KOSPI serves as a barometer for both domestic and international investors. With South Korea being one of Asia’s leading economies, understanding the movements of KOSPI is crucial for investment strategies and economic forecasting.

Current Performance

As of October 2023, the KOSPI has shown a volatile pattern influenced by various global and domestic factors. Recently, the index has experienced fluctuations due to shifts in U.S. interest rates and fears surrounding inflation. On October 15, 2023, KOSPI closed at 2,420 points, reflecting a slight decline from the previous weeks as global economic uncertainties continue to affect investor sentiments. Analysts have attributed these fluctuations to ongoing geopolitical tensions and inflationary trends not only in South Korea but globally, impacting trade and investment flows.

Factors Influencing KOSPI

Several factors contribute to the movement of KOSPI. Firstly, global economic conditions play a significant role; changes in the performance of major economies, especially the U.S. and China, often dictate market behavior. Additionally, the Bank of Korea’s monetary policy is influential, particularly regarding interest rates.

Furthermore, sectors such as technology, automotive, and pharmaceuticals are heavily weighted in the KOSPI, thus their performance directly influences the index. Companies like Samsung Electronics and Hyundai Motor are critical players, and their quarterly earnings reports can result in significant shifts in KOSPI numbers. Recent earnings suggest a mixed outlook, particularly for tech companies, amid a global semiconductor supply chain adjustment.

Conclusion

The KOSPI remains a key indicator of South Korea’s economic health, and by extension, the economic climate in Asia. Given the current global economic challenges, including inflation and monetary policy shifts, analysts suggest that the KOSPI may remain volatile in the short term. However, long-term projections still remain optimistic, especially with South Korea’s innovative industries poised for growth. Investors should stay informed about global developments that could impact the index and adjust their strategies accordingly.