Understanding the USD INR Exchange Rate: Trends and Insights

Introduction

The exchange rate between the US Dollar (USD) and Indian Rupee (INR) is a critical indicator of economic health and international trade between the two nations. Recent fluctuations in this rate have raised concerns and opportunities for investors, businesses, and the general public alike. Understanding the factors influencing this exchange rate is crucial for making informed financial decisions, especially as both countries navigate through post-pandemic recovery and global economic challenges.

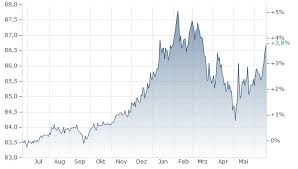

Current Trends in USD to INR

As of October 2023, the USD INR exchange rate has shown signs of volatility, largely influenced by rising inflation rates and adjustments in interest rates by the US Federal Reserve. Currently, the exchange rate stands at approximately 83.50 INR for 1 USD. This represents a slight increase compared to the previous month, where rates were pegged around 82.30. Analysts suggest that sustained high inflation in the U.S. is contributing to the strengthening of the dollar, making imported goods from the U.S. more expensive for Indian consumers.

Factors Influencing the Exchange Rate

Several key factors play a role in the fluctuations of the USD to INR rate:

- Monetary Policy: The decisions made by the Reserve Bank of India (RBI) and the U.S. Federal Reserve regarding interest rates significantly impact the exchange rate. In recent months, the RBI has maintained a cautious stance, keeping interest rates steady to stimulate growth.

- Trade Balances: The balance of trade between the two countries remains a vital determinant. An increase in exports from India to the U.S. could strengthen the Rupee against the Dollar.

- Global Economic Conditions: The ongoing geopolitical tensions and supply chain disruptions are also critical. For example, the conflict in Ukraine has had a ripple effect on global markets, adding further unpredictability.

Conclusion

The USD INR exchange rate plays a significant role in the financial landscape of both India and the United States. With factors such as inflation rates, interest rate policies, and global economic stability continually influencing the rate, it is essential for stakeholders to stay abreast of these developments. Forward-looking businesses and investors must adapt their strategies accordingly to navigate potential risks and seize opportunities in this fluctuating economic environment. As the economies recover and evolve, one can anticipate further changes in the USD to INR rate, making it an area worthy of close observation.