Infibeam Share Price: Current Trends and Analysis

Introduction

Infibeam Avenues Ltd., a key player in the Indian e-commerce sector, has recently gained attention in the stock market due to fluctuations in its share price. Understanding these movements is essential for investors interested in the tech and e-commerce segments of India. As the e-commerce landscape continues to evolve, keeping tabs on stock performance is crucial for making informed investment decisions.

Recent Performance

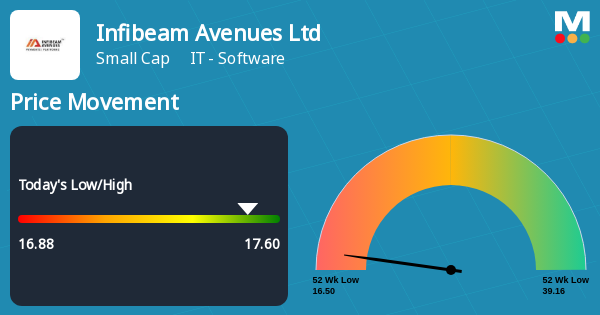

As of late October 2023, the share price of Infibeam has shown significant volatility, opening at ₹45.00 and experiencing fluctuations between ₹40.00 and ₹50.00 over the last few weeks. Analysts have pointed out that this fluctuation is largely due to the company releasing its quarterly earnings report, which indicated an increase in revenue but also highlighted challenges related to operational costs. The company’s market cap currently stands at approximately ₹5,000 crore, reflecting a mixed sentiment among investors.

Market Influence

Several external factors have contributed to the share price changes, including overall market trends, investor sentiment towards tech stocks, and developments in e-commerce policies in India. Recent regulatory changes have prompted discussions among investors about the potential for future growth in online retail, which could directly impact Infibeam’s performance. Additionally, competition from both established players and new entrants in the sector also plays a role in shaping share price expectations.

Future Outlook

Looking ahead, financial analysts predict that Infibeam’s share price will reflect broader market trends but also emphasize the company’s ability to innovate and expand its service offerings. If Infibeam can successfully leverage new technologies to enhance customer experiences and streamline operations, it is likely to attract more positive investor sentiment. Based on current trends and forecasts, investors should keep a close eye on Infibeam’s quarterly releases and industry developments to assess potential buying opportunities.

Conclusion

In summary, Infibeam’s share price movements are indicative of both company-specific realities and broader market dynamics. As a significant player in India’s evolving e-commerce landscape, the company’s future performance remains a key interest for both existing and prospective investors. Understanding these trends will be essential for making informed investment decisions in the coming months.