Current Trends in Nestlé India Share Price

Importance of Monitoring Nestlé India Share Price

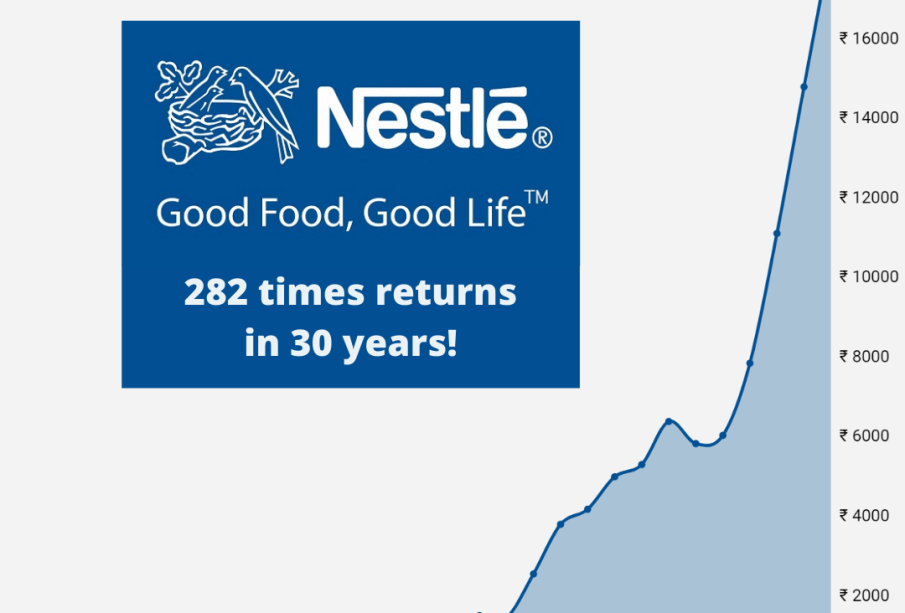

The share price of Nestlé India is not just a reflection of the company’s financial health but also an indicator of the broader consumer goods sector’s performance. Investors and stakeholders closely track these fluctuations to make informed decisions. With the FMCG sector seeing significant changes due to various economic factors, understanding the dynamics of Nestlé India’s share price is crucial.

Recent Developments

As of October 2023, Nestlé India shares have shown notable volatility in the stock market. The share price has fluctuated between INR 18,000 to INR 19,500 over the past month. Analysts attribute this variation to several factors, including changes in consumer demand, supply chain challenges, and overall market sentiment regarding inflation and economic growth.

In the recent Q3 earnings report, Nestlé India reported a 10% increase in revenue compared to the previous quarter, which initially drove the share price up. However, concerns over rising input costs and their potential impact on profit margins have made investors cautious. Furthermore, the company’s ongoing expansion into health and nutrition products is seen as a long-term growth strategy, potentially influencing future share prices positively.

Market Insights

According to market analysts, the outlook for Nestlé India’s share price is mixed. Some predict a recovery in share values as the company adapts to rising costs and continues to innovate its product line. Analysts recommend that investors keep an eye on upcoming product launches and marketing initiatives that may boost sales.

Additionally, the broader economic conditions—such as changes in consumer spending habits and inflation rates—will play a critical role in shaping the performance of Nestlé India shares. The company’s strong fundamentals and established market presence provide a degree of confidence among long-term investors.

Conclusion

In conclusion, the Nestlé India share price remains an essential indicator for investors across the FMCG sector. While short-term fluctuations can cause concern, the company’s strategic initiatives and continuous performance monitoring are likely to impact its long-term growth positively. For potential investors, staying updated on these trends could provide significant insights for making informed investment decisions.