Current Trends in Laurus Labs Share Price

Introduction

Laurus Labs, a major player in the pharmaceutical sector, has garnered significant attention in the stock market, especially among investors focused on healthcare and biotechnology. Analyzing the share price trends of Laurus Labs is crucial for investors seeking to make informed decisions. Recent events in the company and the broader market have impacted its stock performance, making it essential to examine how Laurus Labs is navigating these changes.

Current Share Price Trends

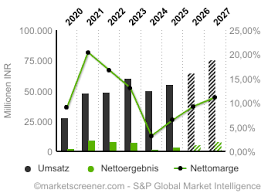

As of October 2023, Laurus Labs shares are trading at approximately INR 500 per share, reflecting a year-to-date growth of around 15%. The stock witnessed a surge following the company’s recent earnings report, where it announced a 20% increase in net profit due to rising demand for its generic products and Contract Development and Manufacturing Organization (CDMO) services. This growth trajectory has made Laurus Labs a prime candidate for investors looking for growth potential in the pharmaceutical industry.

Market Influences

The pharmaceutical sector has been notably influenced by several factors, including increasing global healthcare expenditures and a rising focus on innovative drug development. Laurus Labs is strategically positioned to capitalize on these trends, especially with its strong pipeline of products and partnerships with major pharmaceutical companies. The recent approval of a new generic drug further bolstered investor confidence, contributing to the upward movement of its share price.

Investment Sentiment

Investor sentiment around Laurus Labs remains optimistic, as analysts project a strong growth trajectory for the company over the coming quarters. However, some caution investors about market volatility and the competitive landscape in the pharmaceutical industry. With the upcoming quarterly results expected next month, investors are closely watching to see how these factors will influence share price.

Conclusion

The performance of Laurus Labs shares is indicative of the broader opportunities within the pharmaceutical sector. With continued advancements in drug development and a solid business model, Laurus Labs presents an attractive option for investors seeking long-term growth. Nevertheless, potential investors should remain informed about market trends and company performance in order to navigate the complexities of stock investment. Overall, Laurus Labs demonstrates the dynamic potential within the healthcare industry while facing market challenges head-on.