JioFin Share Price: Latest Updates and Insights

Introduction

The share price of JioFin, a subsidiary of Reliance Industries Limited, has been a focal point for investors in the telecommunications sector. As the telecommunications landscape in India continues to evolve, understanding the fluctuations in JioFin’s share price is essential for prospective investors and market analysts alike. Amidst growing competition in the telecom industry, JioFin stands out as a significant player aiming to expand its market share.

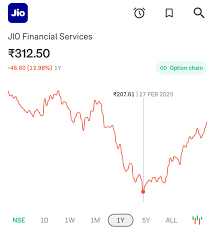

Current Market Performance

As of the latest trading session, JioFin’s share price has seen an increase of 3% from the previous month, closing at ₹550 per share. This uptick can be attributed to a combination of robust quarterly earnings reports and strategic investment plans outlined by the company earlier this year. Analysts note that JioFin’s focus on enhancing customer experience and leveraging technology has begun to yield positive results, leading to higher user acquisition rates.

Impact of Recent Initiatives

Recently, JioFin has launched several initiatives including improved data plans and enhanced customer support services. These efforts aim to solidify JioFin’s position in the competitive landscape dominated by rivals such as Airtel and Vi. Such innovations have not only attracted more subscribers but have also bolstered investor confidence, reflecting positively on the share price.

Market Trends and Future Outlook

The telecommunications industry in India is witnessing significant growth, driven by digitalization and increased smartphone penetration. Analysts predict that the growing demand for data and high-speed internet will further benefit JioFin. However, they also caution that maintaining profitability amidst fierce competition from other telecom giants will be a continual challenge. The upcoming regulatory changes may also influence share prices, making it crucial for investors to stay updated.

Conclusion

In conclusion, JioFin’s share price is on a positive trajectory as the company continues to expand its offerings and adapt to market changes. Investors should keep a close eye on the company’s quarterly performance and market trends that may impact future valuations. While the current outlook appears promising, potential investors should also be aware of market volatility and competitive pressures that could affect JioFin’s growth moving forward.