IDBI Share Price Analysis: Current Trends and Market Impact

Introduction

The share price of IDBI Bank has become a focal point for investors and market analysts due to the recent developments in the Indian banking sector. With the government’s initiatives toward privatization and improving the bank’s performance, understanding the trends in IDBI share price is crucial for investors looking to capitalize on potential growth.

Recent Performance and Trends

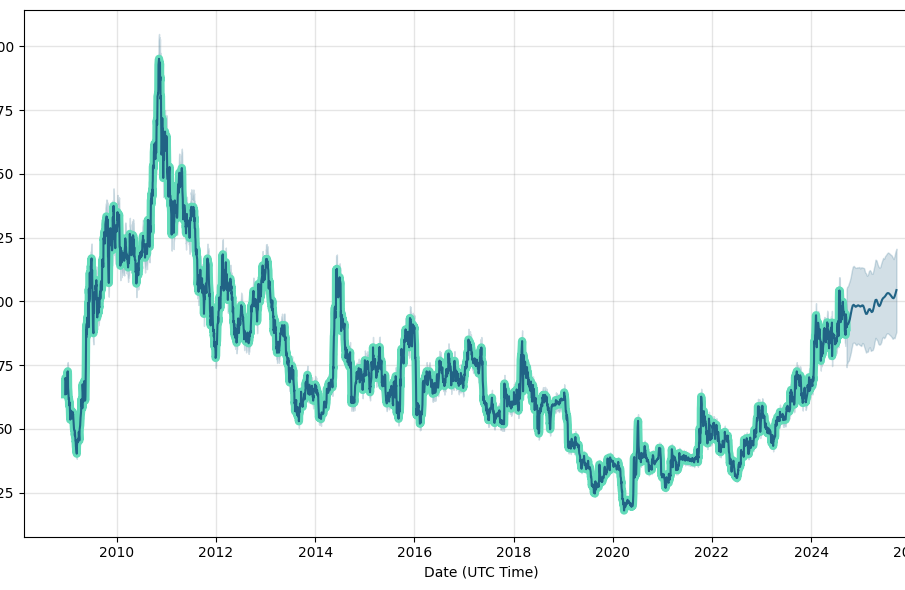

As of October 2023, IDBI Bank’s share price has shown significant volatility driven by both macroeconomic factors and company-specific events. At the beginning of the month, the share price opened at around INR 58.50 and saw fluctuations influenced by quarterly earnings reports, RBI interest rate announcements, and the overall sentiment in the banking sector. Currently, the share price stands at approximately INR 62, showing a robust upward trend fueled by positive quarterly results and a sound capital base.

One of the key factors contributing to the rise in IDBI’s share price is the recent announcement of improved asset quality, as the bank reduced its gross non-performing assets (NPAs) ratio to 8.30%, down from 8.75% last year. This improvement reassures investors of the bank’s financial health and its commitment to strong credit controls. Additionally, the bank’s successful implementation of various retail loan products has bolstered its market position and attracted new customers.

Market Analysis

Analysts predict that the ongoing reforms in the banking sector could enhance IDBI Bank’s operational efficiency. The government is contemplating a move to privatize IDBI Bank, which many believe could lead to better management and more investment inflow. As institutional investors step in, the bank’s share price may continue to experience upward momentum.

Moreover, the broader economic conditions, including inflation rates, foreign capital investment trends, and GDP growth, play vital roles in shaping investor sentiment towards banking stocks. The banking sector index has also seen a positive trend, suggesting a conducive environment for growth.

Conclusion

The IDBI share price reflects both current performance and future growth potential in the wake of favourable market dynamics. Investors should closely monitor the changing economic landscape and the bank’s strategic moves in the coming months. With the ongoing reforms and a focus on strengthening the financial base, IDBI Bank may offer attractive opportunities for both short-term and long-term investors. As always, it is essential to conduct thorough research and consider both risks and rewards when investing in stocks.