Latest Update on MRPL Share Price

Introduction: The Significance of MRPL Share Price

The MRPL (Mangalore Refinery and Petrochemicals Limited) share price is a critical indicator for both investors and stakeholders in the oil and gas sector. As a flagship company in the Indian refining space, MRPL’s share price reflects not only its operational performance but also broader market trends and economic factors impacting the energy sector.

Current MRPL Share Price Trends

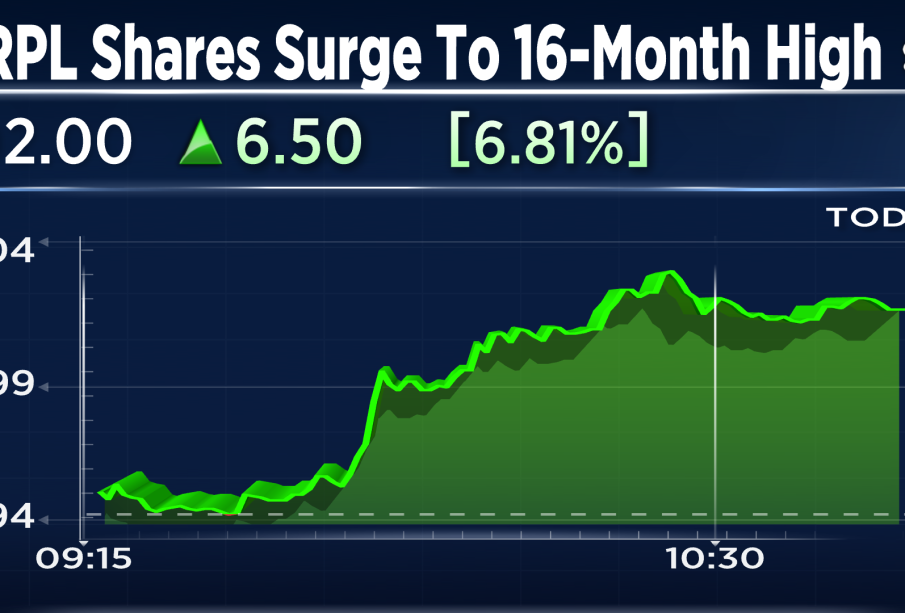

As of the latest trading data from earlier this week, MRPL shares are trading at approximately ₹90 per share. This represents a notable increase of 5% over the past month, driven by positive financial results and an optimistic outlook for the Indian petroleum sector. Investors have reacted favorably following the company’s quarterly earnings report, which highlighted a substantial growth in net profits and better-than-expected refining margins.

Factors Influencing MRPL’s Performance

Several factors have influenced the recent uptick in MRPL’s stock price. Firstly, the recovery in crude oil prices has led to improved margins for refineries across the country. Additionally, MRPL’s strategic initiatives in enhancing refining capacity and optimizing production processes have contributed to increased operational efficiency. Furthermore, the government’s push for the ‘Atmanirbhar Bharat’ initiative has resulted in enhanced demand for domestically refined products.

Market Analysts’ Insights

Market analysts are cautiously optimistic about MRPL’s future performance. Many analysts recommend a ‘buy’ rating on the stock, attributing the positive sentiment to the refinery’s robust fundamentals and favorable market conditions. Predictions suggest that if crude prices remain stabilized and the Indian economy continues to recover from post-pandemic disruptions, MRPL could see further growth in its share price.

Conclusion: Future Outlook for MRPL Share Price

In conclusion, the MRPL share price stands at a pivotal point, reflecting both the company’s strong operational performance and prevailing market dynamics. For current and potential investors, keeping an eye on crude oil trends and global market conditions will be essential. Given the optimistic forecasts surrounding MRPL amidst a recovering economy, the outlook suggests continued interest in the shares, but investors should remain cautious due to volatility in global oil prices.