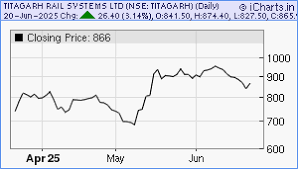

Latest Trends in Titagarh Share Price

Importance of Monitoring Share Prices

Tracking stock prices is essential for investors to make informed decisions, especially in volatile markets. The share price of Titagarh Wagons Limited, a leading player in the Indian transportation and logistics sector, has been in the spotlight due to various market dynamics and company developments.

Current Trends and Market Performance

As of late October 2023, the share price of Titagarh has experienced notable fluctuations. The stock reported a significant rise, reaching an all-time high of INR 420 on October 15, 2023, driven by strong quarterly results and projections of robust demand in the metro rail sector. Industry experts attribute the surge to the government’s focus on infrastructure development, particularly in urban transport.

However, there has been a slight correction in share price in the following days, with the stock trading around INR 390 by October 20, 2023. Analysts suggest that while the company has strong fundamentals and a solid order book, external factors such as macroeconomic conditions and interest rate changes could impact performance. Regular updates on the buy/sell recommendations from leading financial analysts provide further insights into these shifts.

Factors Influencing Share Price

Several factors play a crucial role in the share price of Titagarh:

- Company Performance: Quarterly earnings reports are closely monitored. On October 15, the company posted a 25% increase in net profit compared to the previous quarter, which initially pushed up the share price.

- Industry Developments: The ongoing expansion of metro rail projects and increased production of rolling stock have positioned Titagarh favorably within the industry.

- Market Sentiment: Global economic conditions and domestic policies also affect investor confidence, impacting share prices regularly.

Conclusion and Looking Ahead

In conclusion, keeping an eye on the Titagarh share price is vital for both current and prospective investors. While the stock has shown resilience and potential for growth, investors should remain cautious of market volatility and external economic factors. Analysts predict that with steady projects and government support for infrastructure, the company could see further growth by the end of 2023. Regular monitoring and analysis will help investors make strategic decisions as the market evolves.