Nestle India Share Price: Current Trends and Insights

Introduction

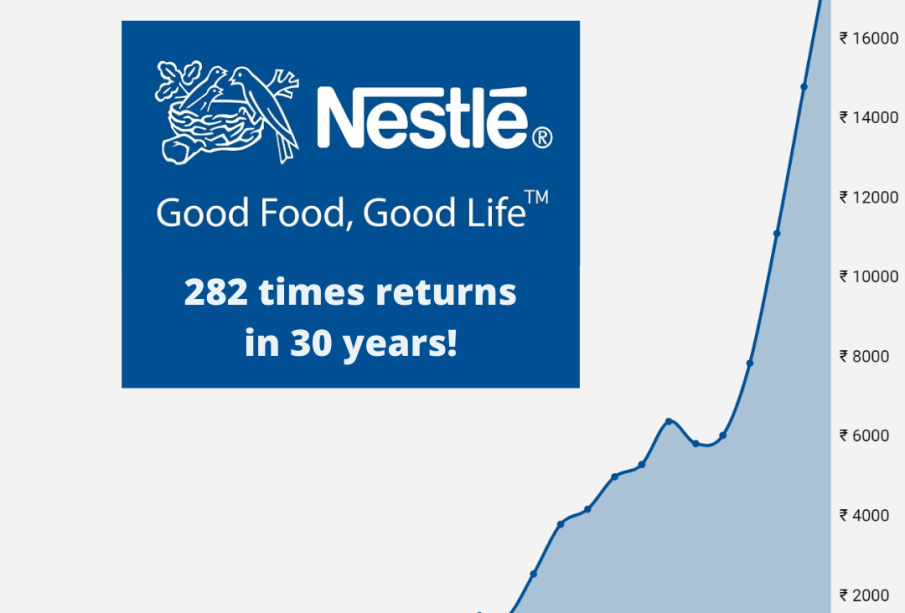

Nestle India, one of the leading players in the fast-moving consumer goods (FMCG) sector, is a pivotal contributor to the Indian economy. Its stock performance reflects not only the company’s growth trajectory but also the broader trends in consumer behavior in the country. As of now, understanding the dynamics of Nestle India’s share price is critical for investors seeking opportunities in the market.

Recent Share Price Trends

As of October 2023, Nestle India’s share price has shown significant volatility amid various economic factors. Currently trading around ₹19,000 per share, the stock has seen fluctuations owing to changes in consumer demand and input costs. The company recently announced its quarterly results, showcasing a revenue growth of approximately 9% year-on-year, attributed largely to strong demand for its dairy and nutrition products.

In the stock market, analysts have noted that Nestle India’s share price is closely linked to the overall performance of the FMCG sector, which has been influenced by rising inflation and changing consumer sentiment. However, Nestle’s strong brand portfolio, including Maggi, Nescafé, and KitKat, continues to retain customer loyalty, thus providing some cushion against economic headwinds.

Market Analysis and Future Outlook

The investment community is optimistic about Nestle India’s long-term growth potential. Analysts predict that with the easing of supply chain disruptions and potential price stability, the company’s margin could improve, enhancing its attractiveness for investors. The introduction of new products and expansion into tier two and tier three cities also presents opportunities for growth.

However, it is essential for potential investors to remain cautious. With the underlying challenges posed by fluctuating raw material costs and an unpredictable economic environment, the share price might experience continued volatility. Analysts advise keeping an eye on global commodity prices and domestic consumption patterns, as these will play crucial roles in shaping Nestle India’s future price performance.

Conclusion

In conclusion, the share price of Nestle India remains a key indicator of both the company’s operational health and the overall FMCG sector dynamics in India. For investors, staying informed about market conditions and understanding the broader economic context will be vital in making sound investment decisions. As the company navigates through the current challenges while continuously innovating and expanding its market presence, the future of Nestle India’s share price remains promising.