Nestlé India Share Price: Current Trends and Insights

Introduction

Nestlé India, a leading player in the food and beverage industry, has always been a significant stock on the Indian stock exchange. The performance of its share price is an essential topic for investors, analysts, and market watchers, indicating the company’s financial health and market sentiment. With the recent fluctuations in the stock market influenced by various economic factors, keeping an eye on Nestlé India’s share price becomes even more critical for stakeholders.

Current Share Price Trends

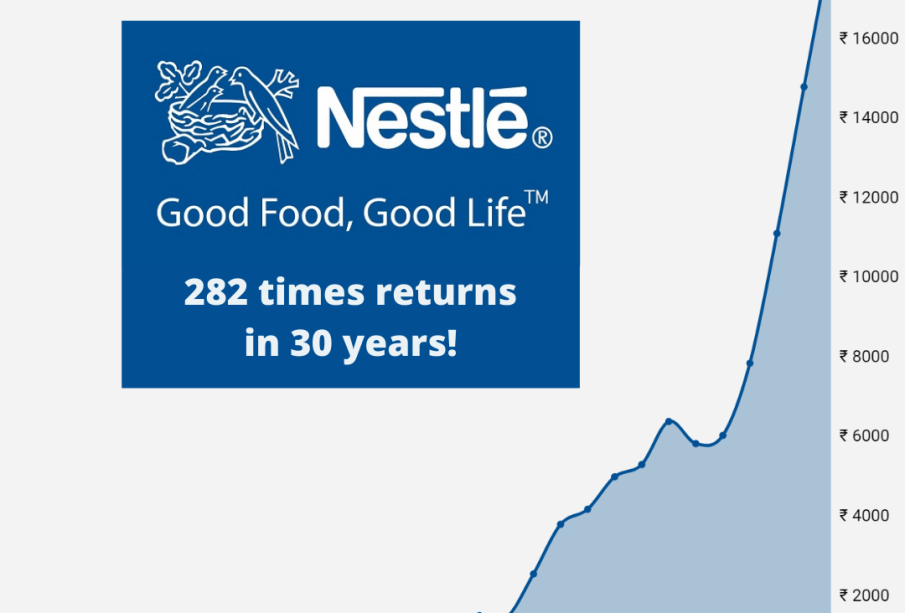

As of October 2023, Nestlé India’s share price has shown a notable uptrend. Reports indicate that the stock has risen by approximately 12% over the last three months, buoyed by positive quarterly earnings. The company’s latest financial results announced a revenue growth of 10% year-on-year, driven by strong demand for its key products like Maggi noodles and Nescafé coffee. Moreover, the company’s commitment to sustainability and health-oriented products has further strengthened its market position, attracting more investors.

Market Influencers

The share price of Nestlé India is influenced by various factors, including economic conditions, consumer trends, and competition. Recently, the easing of inflation in raw materials cost has favored food manufacturers, helping boost profits for companies like Nestlé. Furthermore, changes in consumer behavior towards healthy eating have led to increased sales of nutritious products, reinforcing Nestlé’s strategy and market share.

Future Projections

Market analysts remain optimistic about Nestlé India’s future share price movements. Predictions suggest that the company could see a further 8-10% growth in share price over the next twelve months, contingent upon continued revenue growth and effective cost management. Investors are advised to keep an eye on the upcoming product launches and innovations that could influence consumer demand and overall company performance.

Conclusion

In summary, Nestlé India remains a strong player in the stock market, with a favorable share price trajectory influenced by various internal and external factors. For investors, staying informed about market trends and the company’s initiatives is crucial for making educated decisions. As Nestlé India continues to adapt to changing market conditions and consumer preferences, its share price will undoubtedly reflect these dynamics. Continuous monitoring of the stock is recommended for those interested in capitalizing on potential growth.