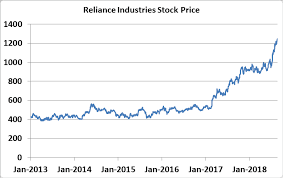

Current Trends in Reliance Industries Share Price

Introduction

Reliance Industries Limited (RIL) is one of India’s largest conglomerates with diverse interests in petrochemicals, refining, oil, telecommunications, and retail. As a publicly traded company on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), RIL’s share price is a significant indicator of market trends and investor confidence. The performance of its share prices is crucial for both individual investors and market analysts, as it often reflects the broader economic climate of India.

Recent Developments

As of October 2023, Reliance Industries shares have shown substantial volatility due to various factors impacting the economy and the company’s sector. Recently, the share price saw a slight decline, trading around ₹2,450, down from a peak of ₹2,550 in late September. Analysts attribute this fluctuation to factors such as fluctuating global oil prices, regulatory changes, and the ongoing competitive landscape in its telecom and retail divisions.

Moreover, recent quarterly earnings reports provided mixed signals. While revenue growth has continued, some analysts expressed concerns regarding the rising costs of raw materials and operational challenges. Additionally, the company has invested heavily in green energy, which, despite its long-term potential, has added to immediate expenses.

Market Reactions

Investor sentiment has been cautiously optimistic. RIL’s consistent investment in technology and infrastructure is being viewed positively, particularly as it expands its digital services through Jio Platforms. The company’s commitment to diversifying its portfolio with renewable energy projects may serve as a significant growth catalyst in the long run.

Market experts recommend that investors keep a close watch on macroeconomic indicators, such as inflation rates and global oil prices, which can greatly influence Reliance’s shares. Furthermore, news regarding mergers, acquisitions, or partnerships in the rapidly evolving tech space could also affect stock value.

Conclusion

In conclusion, while Reliance Industries remains a giant player in multiple sectors, the recent fluctuations in its share price underscore the complexities of market dynamics and investor sentiment. For investors, it is crucial to stay informed about both the company’s internal developments and external economic factors. Balancing long-term growth strategies with short-term market volatility will be essential for stakeholders moving forward. As Reliance continues to innovate, particularly in the renewable energy space, its medium to long-term share price outlook could still remain robust, making it a stock worth monitoring closely.