Kalpataru IPO: What Investors Need to Know

Introduction to Kalpataru IPO

The upcoming Initial Public Offering (IPO) of Kalpataru, a leading player in the infrastructure and real estate sector in India, has caught the attention of both institutional and retail investors. As companies look to raise capital for expansion and operational needs, the Kalpataru IPO represents a significant opportunity in the market. With increasing demand for infrastructure projects in India, this public offering is timely and relevant.

Details of the Kalpataru IPO

Kalpataru is expected to launch its IPO in the next quarter, with an aim to raise approximately INR 1,500 crores. The funds generated from this offering will primarily be utilized for debt repayment, financing new projects, and enhancing working capital. According to industry sources, Kalpataru’s financial performance has shown steady growth, with revenues steadily increasing by 15% year-on-year. Moreover, the company has a robust order book of over INR 25,000 crores, providing earnings visibility for the coming years.

Market Trends and Investor Sentiment

As of October 2023, the IPO market in India has been experiencing a renewed surge, attributed to favorable government policies and a robust economic recovery post-pandemic. Analysts predict strong demand for Kalpataru’s shares upon the opening of the subscription period, owing to the company’s established market presence and growth trajectory. Furthermore, market analysts believe that urban infrastructure development will continue to receive substantial government support, further augmenting investor interest in the IPO.

Conclusion: What This Means for Investors

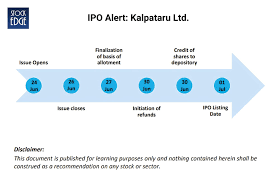

The Kalpataru IPO is poised to be one of the noteworthy offerings in the current financial climate, marking a crucial step for the company in its growth journey. For potential investors, this IPO could represent a valuable opportunity to invest in a well-established company focused on key infrastructure projects within India. As the details regarding the price band and allotment process are expected in the coming weeks, investors are encouraged to conduct thorough research to gauge the potential risks and rewards before participating in this IPO. In conclusion, Kalpataru’s public offering reflects the ongoing trends in India’s infrastructure growth and offers a glimpse into the future potential of its business initiatives.