Latest Trends in Kaynes Technology Share Price

Introduction

Kaynes Technology Solutions, a prominent player in the electronics manufacturing sector, has garnered significant attention in recent months, especially after its debut on the stock market. As investors and analysts closely watch its share price, understanding the factors influencing this trend becomes crucial. With an increasing focus on technology-driven solutions in various industries, the relevance of Kaynes Technology in the current market landscape cannot be understated.

Latest Developments

Since its Initial Public Offering (IPO) in late 2022, Kaynes Technology’s share price experienced considerable fluctuations. Initially priced at ₹650, the share saw an impressive surge to ₹880 within the first month, reflecting strong investor confidence and demand. However, market corrections and external economic factors led to fluctuating prices over the following months.

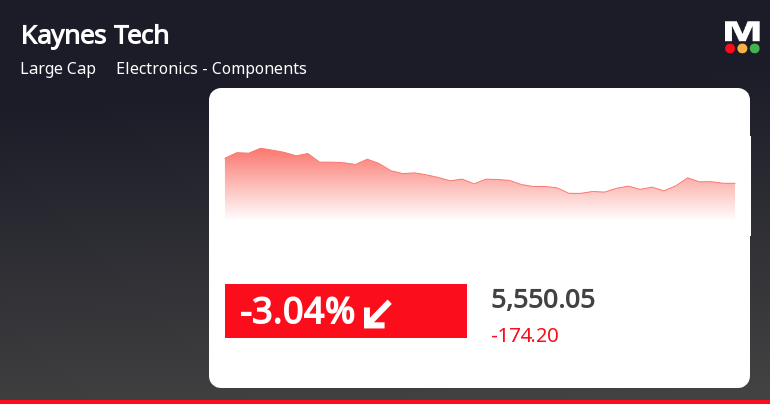

As of October 2023, Kaynes Technology’s share price is approximately ₹740. Analysts attribute this recent decline to a combination of profit-booking by short-term investors and overall market trends influenced by global economic uncertainties. The company’s earnings report, which indicated a robust growth in revenue by 25% year-on-year, did little to stabilize the share price in the short term. Market responses suggest mixed sentiments toward ongoing challenges such as supply chain disruptions and inflationary pressures.

Market Trends and Investor Sentiment

Data indicates that Kaynes Technology is well-positioned in the burgeoning fields of Artificial Intelligence and IoT solutions, enhancing its long-term growth trajectory. The increasing demand for smart technology across sectors is likely to influence share prices positively in the future. Analysts forecast that as stability returns to the global economy and technology investments rebound, Kaynes Technology’s share price could regain momentum.

Conclusion

In conclusion, Kaynes Technology’s share price remains a focal point of interest for investors. While current market trends exhibit volatility, the underlying fundamentals of the company suggest potential for recovery and growth. Stakeholders are advised to keep an eye on forthcoming financial reports and global market indicators, as these will significantly affect the company’s stock performance. With the technology sector expected to expand further, Kaynes Technology could well become a valuable investment opportunity in the coming months.