Current Trends in Trent Share Price and Market Impact

Introduction

Trent Limited, a major player in the Indian retail sector, has been making headlines with its share price dynamics. Understanding the fluctuations in Trent’s share price is crucial for investors, analysts, and anyone interested in the Indian economy. Trent operates popular retail chains like Westside and Star Bazaar, and its performance can be indicative of broader market trends in the retail segment.

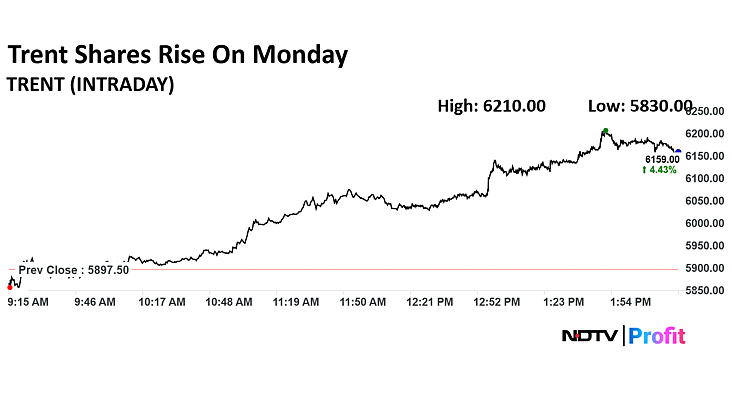

Recent Performance

As of October 2023, Trent’s share price has shown notable variability, influenced by various factors, including quarterly earnings reports, market sentiment, and economic conditions. In the recent trading sessions, the share price hovered around ₹1,210, reflecting a slight increase of about 3% from the previous month, attributed to positive sales growth reported during the festive season.

Market analysts attribute this rise to the company’s strategic initiatives to enhance its online presence and expand its physical outlets. Trent has reported robust growth in its e-commerce segment, with a year-on-year increase of 25% in online sales, which has significantly contributed to the overall revenue boost.

Market Influences

Several factors are impacting Trent’s share price, including:

- Economic Conditions: The retail market in India is witnessing a rebound as consumer spending increases post-pandemic, which bodes well for companies like Trent.

- Competitor Movements: Competitors are adopting aggressive pricing strategies, and Trent’s ability to maintain its market share is crucial for investor confidence.

- Global Trends: Influences from global markets, such as fluctuations in commodity prices and international retail trends, also play a role in shaping investor perceptions.

Conclusion

As we move forward, it will be essential for investors to keep a close watch on Trent’s quarterly performance and the overall health of the retail sector. Analysts remain optimistic about Trent’s capacity to manage competition and leverage growth opportunities, suggesting a stable outlook in the medium to long term. Potential investors should consider both the current market conditions and Trent’s strategic initiatives before making decisions. The share price not only reflects company performance but is also a bellwether for the retail landscape in India.