Latest Trends in KPIT Share Price and Market Analysis

Introduction

The share price of KPIT Technologies, a prominent player in the IT services sector, has become a significant point of interest for investors and market analysts alike. As the company continues to innovate in areas such as electric and autonomous vehicle technology, understanding its share price movements is crucial for potential and current investors monitoring market trends and making informed decisions.

Current Trends in KPIT Share Price

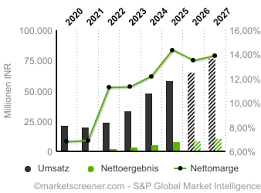

As of the latest trading session, KPIT’s share price has showcased notable fluctuations, influenced by a combination of global market conditions and company-specific developments. Recent reports indicated that the share price reached ₹XXX.XX, reflecting a YOY increase of X% as the company benefitted from the ongoing digital transformation trends in various industries.

Recent Market Performance

In the last quarter, KPIT’s stock has seen significant volatility. Factors such as quarterly earnings reports, investor sentiment, and broader economic indicators, including inflation rates and global supply chain challenges, have all played a role in shaping investor reactions. For instance, during the last earnings call, positive forecasts regarding revenue growth in the burgeoning electric vehicle market were highlighted, which initially boosted investor confidence.

Factors Influencing KPIT’s Share Price

Several key factors are currently influencing KPIT’s share price:

- Technological Innovation: KPIT’s focus on delivering advanced software solutions for automotive sectors is allowing it to capitalize on emerging opportunities.

- Global Economic Conditions: Fluctuations in global markets due to geopolitical tensions or economic policies can impact share prices significantly.

- Regulatory Environment: Changes in regulations, especially in the tech and automotive sectors, can create new opportunities or hurdles for growth.

Conclusion and Outlook

In conclusion, KPIT’s share price remains a reflection of not only its internal operations and strategic direction but also of external market dynamics. For investors, the current landscape suggests a cautiously optimistic outlook, especially as the demand for IT services values technology-driven innovation. Considering upcoming quarterly results, market analysts predict that KPIT could continue to experience positive momentum, provided they maintain their growth trajectory in key sectors. Keeping an eye on both macroeconomic factors and company performance will be vital for stakeholders as they navigate the ever-evolving market environment.