Latest Trends in VMM Share Price

Introduction

The VMM share price has been a topic of significant interest among investors and market analysts recently. As the stock market remains volatile, understanding the dynamics surrounding VMM’s share performance is crucial for making informed investment decisions. The current market conditions and economic factors are shaping the perceptions of VMM’s valuation and future growth potential.

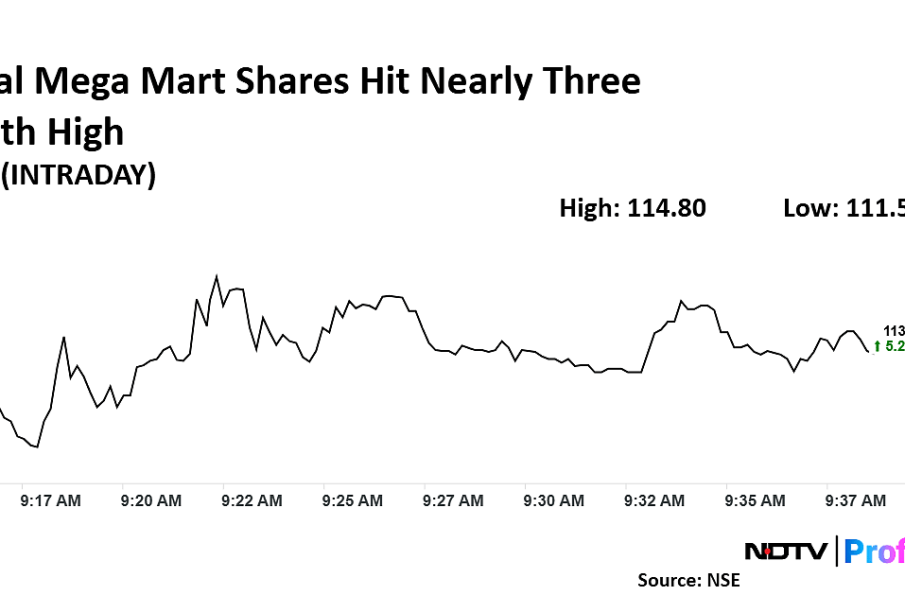

Recent Performance

In the past month, VMM shares have experienced a fluctuating trajectory. Starting at a price of ₹150, the shares peaked at ₹175 before witnessing a slight decline back to the ₹160 mark. This movement can be attributed to both company-specific announcements and broader market trends. Analysts suggest that the recent quarterly earnings report showed an increase in revenue, which initially boosted investor confidence.

Market Influences

Several external factors are influencing the VMM share price. The overall economic climate in India, particularly with the recent inflation rates, has made investors cautious. Additionally, global market trends, especially in tech sectors, have also played a role in driving VMM’s stock performance. The company’s strategic partnerships and innovations introduced in their product line have generated buzz, potentially leading to a positive impact on future pricing.

Outlook and Predictions

Looking ahead, market analysts predict a cautious yet optimistic outlook for VMM shares. If current trends in consumer demand continue and the company successfully navigates the economic challenges, there could be potential for growth. Key upcoming events such as investor meetings and product launches are anticipated to significantly influence share price movements.

Conclusion

The VMM share price reflects a mix of both optimism and caution among investors. For those considering investment in VMM, staying updated with market trends and company announcements is essential. As the market continues to evolve, the performance of VMM shares will strongly depend on both internal business strategies and broader economic factors. Investors are advised to keep a close eye on these developments to make well-informed decisions.